By Alex White, Head of ALM Research, Redington

So what does this mean for investors? One area to consider is long-dated fixed income.

Long-dated, investment grade fixed income instruments are a natural investment for any investor with long-term liabilities. If an investor has a sufficiently long horizon that they can handle the volatility, they can benefit. These bonds provide interest rate protection, and do so with a material pickup in spreads over government bonds which, over the long-term, has generally compensated investors for losses due to defaults. And in turbulent times, there’s a case for picking simpler assets. With spreads wide, and with government programs to buy high grade debt, in many ways now is a great time to buy long dated bonds and lock in the higher spreads.

So why wouldn’t you?

One reason is there may be better opportunities elsewhere. High yield has outperformed over the long-term, but is also is much shorter-dated so has typically been less volatile than “safer” but longer-dated investment grade credit. High yield is also trading at much wider spreads. We can do some rough calculations to compare the two.

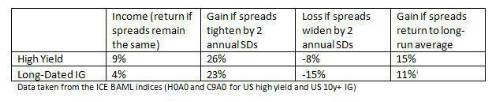

Within the chart below which covers a two-year time horizon, we have used approximate default loss assumptions of 3% and 30bps per annum, based on long-term historical averages, alongside simple second-order estimates and assumed duration declines at half a year per year. We have considered shocks equal to a 2 standard deviation (annual) move up or down, and a return to the long-term average levels (5.5% and 1.8%).

Income (return if spreads remain the same) Gain if spreads tighten by 2 annual SDs Loss if spreads widen by 2 annual SDs Gain if spreads return to long-run average

You can see that the shocks are somewhat arbitrary. What we can take from them though is that:

• the extra income from high yield provides a potent buffer, and

• the lower duration helps offset the higher spread risk

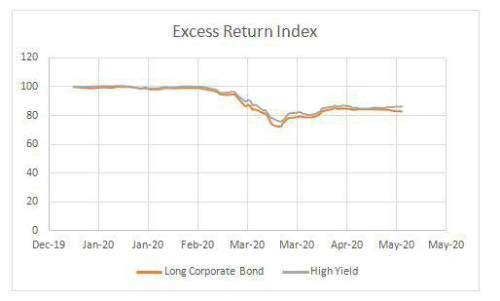

We can also see the effect of duration in recent moves. From 31st December 2019 to 11 May 2020, in excess terms high yield losses were lower than long-dated investment grade, despite spreads widening nearly 300bps further in high yield.

So there may be better opportunities.

There’s also a more philosophical reason - long-dated, high grade bonds are, in a sense, a bet that things will stay the same.

We expect very large companies to still be around in a few years’ time, and that they will be able to pay their debts. Credit investing, at its core, means taking tail risk. Investors earn a small return in most circumstances but risk large losses if the world changes dramatically (for example, if an industry becomes obsolete).

Whether the changes caused by Covid-19 are enough to change the calculus, there’s a reasonable case that the world is changing more and faster than normal. If that’s a concern, equities or shorter-dated credit (such as TALF-backed ABS) might be more suitable investments than long-dated investment grade.

As is often the case with similar decisions, there are good reasons to buy long-dated corporate bonds, and good reasons not to. So while the best option will vary from investor to investor, we come back to the truism that a diversified portfolio is likely to be a better bet than a concentrated one. That’s one thing that will never change.

|