New insight from Canada Life shows the benchmark average ‘healthy’ annuity rate for someone age 65 has almost reached 6%.

This is for a single life annuity with a guarantee period of 10-years which would pay out £5,800 a year in income. For someone age 70 the reference income would be £6,368 (6.37%).

But is now the right time to reconsider annuities, or is there more to come by way of rate improvements?

Nick Flynn, retirement income director, Canada Life explains: “The positive movement in rates over the last four months in one of the most significant I’ve witnessed, with a 30% uplift in Canada Life rates since the turn of the year. The trigger has been the moves in base rate while the open market annuity providers have also been seeking market share by offering better rates.

“The outlook for annuity rates will continue to remain positive while fiscal policy unwinds quantitative easing and the Bank of England grapples with inflation. The most recent base rate moves have been priced into the rates you can buy today, but it will always be wise to shop around for your annuity, as not only will you secure the best lifetime income in the open market, but you will also buy the right shape.

“Buying an annuity is a significant financial step and an adviser or annuity broker will be best placed to help understand the choices available.”

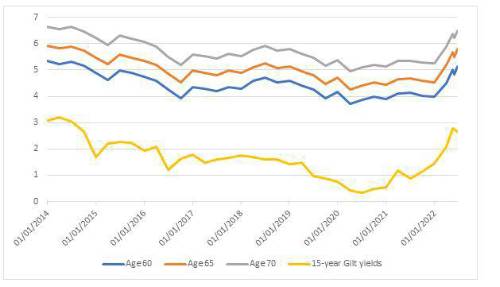

Annuity Rates over time

Source: Canada Life benchmark annuity rates as at 30.6.2022. £100,000 purchase price, healthy single life with 10-year guarantee. Reference 15-year Gilt yields taken from FT.com

Some pros and cons of buying an annuity

Pros

• 100% secure lifetime income, not linked to the stock market

• Your health and lifestyle could significantly improve the rate you are offered, so always disclose these to your adviser, annuity broker or annuity provider

• You can combine annuities and drawdown, it doesn’t need be an ‘either / or’ decision

Cons

• If you die ‘early’, your estate may not get your money back, unless you have the right protection in place

• Your income will be fixed and offer no flexibility, unless you opt for some form of inflation linked escalation which is expensive

• Don’t accept the offer from your existing pension company, always shop around the open market for the best shape and rate

Nick Flynn concludes: “As with any financial decision, take your time to consider your options and seek advice. With a significant improvement in rates over the past few months, annuities should be worth a second look. With the right shape and best rate not only will you guarantee a lifetime of income, but you can also protect your loved ones.”

|