MGM Advantage has analysed various retirement income options to see which could potentially offer the best way to counter the effects of inflation eroding your retirement income.

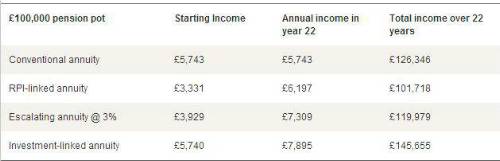

By modelling four options; conventional annuity, inflation-linked annuity, an annuity increasing at 3% a year and an investment-linked annuity, the company has worked out the total income from each over a typical 22-year retirement.

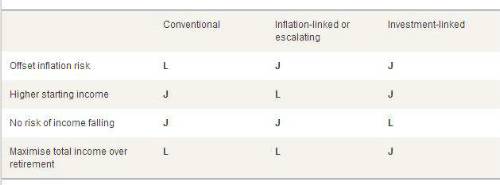

The conclusion is stark, conventional annuities pay a higher starting income than inflation-linked annuities, but over time, inflation can erode 50%2 of your purchasing power. Inflation-linked or escalation options, although protecting your purchasing power from the ravages of inflation, offer a much lower starting income than conventional annuities. The total income over time is also less than conventional annuities, typically between 5% and 24%.

Investment-linked annuities, by contrast, can potentially offer the best of both worlds, with a flexible income which can initially match or exceed a conventional annuity, and the ability to help protect your income from inflation through the returns from equities.

Andrew Tully, pensions technical director, MGM Advantage commented: "Inflation remains a key issue for people considering retiring, who find themselves caught between a rock and a hard place with low annuity rates and inflation running above target. Nothing disintegrates under the glare of inflation like a fixed income."

The numbers

Tully continued: "With the forecast for inflation to remain above 2%, and possibly above 3% in the short term, people retiring today who need to generate an income should be considering all of their available options. For example, you could secure a base income using a conventional annuity and then invest the balance of your pension in an investment-linked annuity, which provides a hedge against inflation.

"Of course, you need to be comfortable with the level of risk, which is why it pays to do your homework and seek independent financial advice. At the end of the day, your retirement annuity choice is a once in a lifetime opportunity. But as people live longer, it's clear one of the greatest risks for retirees is simply ignoring inflation altogether."

Pros and cons of each annuity option

|