GlobalData’s insurance database reveals that life insurance accounted for a 77.4% share of Japan’s total insurance premiums in 2024, while general insurance occupied the remaining 22.6% share. The industry's expansion over the next five years will be fueled by demographic and regulatory changes and growing demand for policies covering natural-catastrophic (nat-cat) events and cyber incidents.

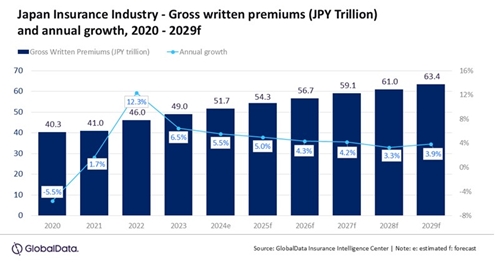

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: "The Japanese economy is expected to contract by 0.9% in 2024 after growing by 1.9% in 2023, which is expected to slow down the growth of the insurance industry. However, economic recovery, rising demand for yen-denominated insurance products, and premium price increases across life and general insurance segments are expected to support the industry’s growth in 2025."

Japan's life insurance sector is expected to grow by 5.9% in 2025. An aging population and increasing life expectancy are significant factors driving the demand for life insurance and annuity products in the country. According to the National Institute of Population and Social Security Research, individuals aged 65 and above accounted for a 29.3% share of the population in 2024. This figure is projected to reach 34.8% by 2040, which will support the growth of life and health insurance.

Sahoo adds: “Favorable regulatory changes will also support life insurance growth. The Financial Services Agency's (FSA) intervention in January 2024 to limit the sale of foreign-currency-denominated insurance products has prompted several banks to shift their focus back on yen-based insurance products. Life insurance is projected to grow at a CAGR of 4.4% over 2024-29.”

Japan’s general insurance is projected to grow at a CAGR of 2.2% from 2024-29. The growth in general insurance will be supported by rising premium rates across general insurance lines, growing demand for policies covering nat-cat events, and rising popularity of liability insurance policies. However, a slower growth in motor insurance, which accounts for almost half of the general insurance premiums, is expected to slow down the growth for Japan’s general insurance industry.

Sahoo continues: “The increase in the frequency and severity of extreme weather events in recent years has led to a rise in claims. As a result, insurers are expected to reassess their risk exposure, potentially leading to higher insurance premium rates across general insurance lines in 2025.”

Since 2020, the General Insurance Rating Organization of Japan (GIROJ) has regularly raised the nationwide average “reference net rate” which serves as a guideline for personal fire insurance premiums. This continuous increase reflects the sharp increase in insurance payments due to a series of natural disasters, as well as rising repair costs.

Among the general insurance lines of business, liability insurance is expected to witness the highest growth in 2025, driven by an increase in demand for cyber insurance and workmen compensation policies.

Sahoo concludes: “Japan's insurance industry is on the verge of transformation, driven by demographic shifts and evolving consumer preferences. However, challenges such as market volatility, regulatory changes, and frequent nat-cat events will require adaptive strategies from insurers to sustain growth and profitability over the next five years."

|