|

|

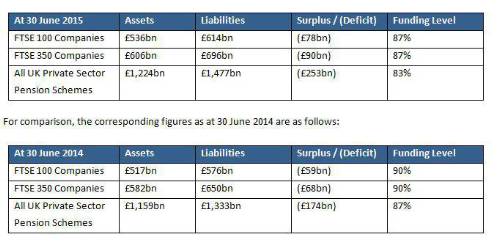

JLT Employee Benefits (JLT) has updated its monthly index, showing the funding position of all UK private sector defined benefit (DB) pension schemes under the standard accounting measure (IAS19) used in company reports and accounts. As at 30 June 2015, JLT estimates the total DB pension scheme funding position as follows: |

Charles Cowling, Director, JLT Employee Benefits, comments:

“As we come ever closer to a “Grexit” from the Euro, the rattled financial markets certainly aren’t helping the funding position of pension schemes.

“Total pension scheme deficits are slightly down on a month ago, but deficits are still significantly higher than a year ago. There are signs that pension schemes are increasingly implementing LDI solutions to hedge out interest rate and inflation risks – even though this means “locking in” to current yields. But with markets looking increasingly uncertain, companies and trustees are quite reasonably concluding that running significant risks on interest rates and inflation (and thereby betting against market prices) is a mug’s game which is best avoided.

“Even if LDI solutions are increasingly reducing interest rate and inflation risks, companies and trustees are still in for a “white knuckle ride” in markets, as pension scheme deficits swing up and down with every twist and turn in the saga of Greece, its debts and the European currency union. Beware Greeks bearing gifts (or bailout proposals) seems to be the lesson being taken to heart by the EU – and possibly too by companies and trustees of DB pension schemes.”

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.