Flurry of deals have closed in late 2016 despite challenging market conditions

Quotations are currently available for very small schemes due to more efficient processes developed by one insurer

However, 2016 buy-in/buyout new business volumes are likely to finish lower vs. the last two years

JLT finds that some schemes are deferring buying in some or all of their liabilities until yields rise. However, schemes need to weigh the risk of waiting for yields to rise, against delaying and seeing a rise fail to materialise, whilst liabilities deteriorate further*. Also, it’s usually the relative rather than the absolute price that matters in a deal and it can be less obvious how this will change as yields rise.

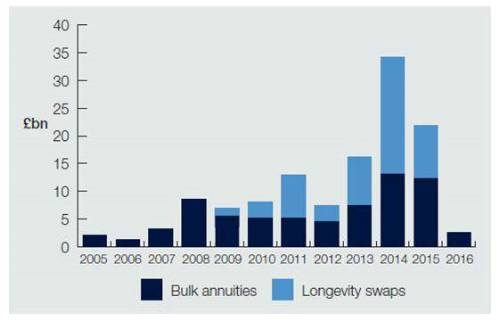

The report, which looks at the key developments and pension buyout market activity in Q4 2016, projects that transactional activity in 2016 will be short of the 2014 and 2015 volumes which totalled £13.2bn and £12.4bn respectively. However, when a couple of relatively large back-book transactions are included (£6bn and £3bn transfers of annuities from AEGON to Rothesay Life and Legal & General), insurer capacity deployed so far over 2016 does not look dissimilar to 2014 and 2015 levels.

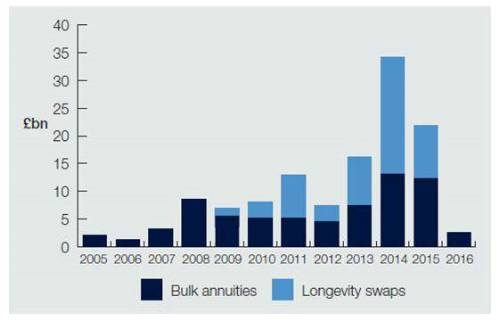

Graph: Bulk annuity and longevity swap market volumes 2005-end June 2016

The largest deals so far in 2016 are the £1.1 billion buyout of the Vickers Group Pension Scheme with Legal & General; the Electricity Supply Pension Scheme’s £1bn longevity swap with Abbey Life; and Aon Retirement Plan’s £900m buy-in with PIC. Additionally, the ICI Pension Fund has completed a further five buy-in tranches this year, including a £750 million buy-in with Legal & General and a £630 million buy-in with Scottish Widows.

Ruth Ward, Senior Consultant at JLT Employee Benefits, commented: “We are aware of plenty of cases where schemes have been ready to complete a buy-in or buyout but have delayed in the expectation of an improvement in pricing which has just not materialised.

“In contrast, a number of schemes we advise have seized the opportunity to transact on acceptable buy-in/buyout terms over the last few weeks. We are encouraged that even the very smallest schemes of less than £1m have been able to obtain buyout quotations, allowing them to settle their pension liabilities. The market has got more difficult for such schemes over the last couple of years, but one insurer, Aviva, has developed more efficient processes to cater for this end of the market, whilst continuing to quote on mid-large deals.

“Our view is that trustees and sponsors should insure their liabilities as soon as they can afford to do so. There is no guarantee that the position will look better in future and, even if it does, it may prove more difficult to get a quotation and execute a transaction. In practice, this is likely to mean that trustees for all but the smallest schemes insure their schemes’ pensioner liabilities (or subsets of these) in the first instance, and cover more members at a later date.

“This time last year there was a lot of speculation that Solvency II would have a big impact on non-pensioner liabilities, but many buyout deals (covering both current and deferred pensioners) have still gone ahead including L&G’s recent £1.1bn transaction. In fact, we have seen a flurry of late deals closing this quarter despite current market conditions.”

|