JLT Employee Benefits (JLT) has updated its monthly index, showing the funding position of all UK private sector defined benefit (DB) pension schemes under the standard accounting measure (IAS19) used in company reports and accounts.

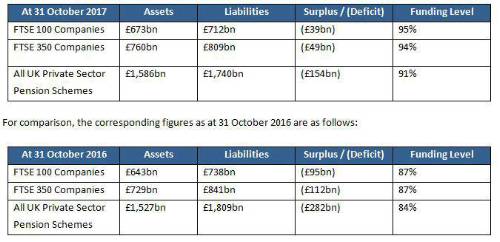

As at 31 October 2017, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Despite concerns over rising inflation, buoyant equity markets have continued to deliver good news for DB pension schemes as pension deficits continue to drift lower.

“This month has seen the Consumer Prices Index measure of inflation hit 3% for the first time since 2012, largely due to the weak pound after the Brexit vote. As a result, the Governor of the Bank of England, Mark Carney said that it was ‘more likely than not’ that he would soon be writing to the Treasury to explain his failure to keep inflation within 1% of its target of 2%.

“In responding to questions from the Commons Treasury select committee, Carney also gave further indications of an impending interest rate rise. Referring to the balance between targeting rising prices and keeping interest rates low to support jobs and activity, he said that the ‘trade-off has moved away’ from using interest rate policy to support employment.

“Of course, after nearly 10 years of painful reductions, rising interest rates will be seen as a relief for pension schemes as it will reduce the value attached to their liabilities. As a result many will be hoping to see continued reductions in pension deficits.

“However, many challenges still remain. Pension schemes which are carrying out actuarial valuations in 2017 are likely to show bigger deficits than in 2014, and finance directors, will therefore be facing trustees asking for ‘more please’. But, for now, trustees and finance directors may wish to take advantage of these slightly calmer waters to explore opportunities to offload and settle pension liabilities.”

|