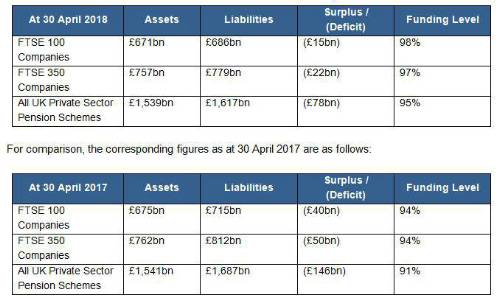

As at 30 April 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Markets continue to be positive for pension schemes and overall reported pension deficits are showing a strong improvement from twelve months ago. Indeed, the FTSE 100 is close to showing an aggregate surplus in its pension schemes for the first time in almost a decade. This is despite the recent poor GDP figures suggesting the UK economy is on the brink of stagflation.

“Crucially though, for pension schemes, is the outlook for interest rates. It had been thought quite likely that the Bank of England’s Monetary Policy Committee would raise interest rates at their next meeting on May 10th but the latest weak GDP growth figures may once again have put back the date of the next interest rate rise. Additionally, the Bank of England is currently debating introducing greater clarity in its future interest rate plans, which would be of significant interest to pension schemes as they seek to plan and navigate their de-risking paths.

“This month has seen the latest annual funding statement from the Pensions Regulator. It contains a number of stark warnings that the Regulator will be taking a tougher stance on lengthy recovery plans and situations where dividends to shareholders are greater than deficit recovery contributions to pension schemes. The Regulator also gave a clear warning that it is prepared to flex its muscles and use its intervention powers if it is unhappy at how pension deficits are being managed.

“One of the key problems for many companies is that the pension deficit calculated by scheme trustees, which determines the cash funding required to be paid by the employer, is significantly greater than the pension deficit reported in the employer’s accounts.

“With both the latest Regulator funding statement and the Government’s White Paper on Protecting Defined Benefit Pension Schemes promising a tougher stance on pension funding and an increase in the protection of members’ benefits, now may be a good time for companies and trustees to take advantage of recent positive market conditions and reduce risk in their pension schemes.”

|