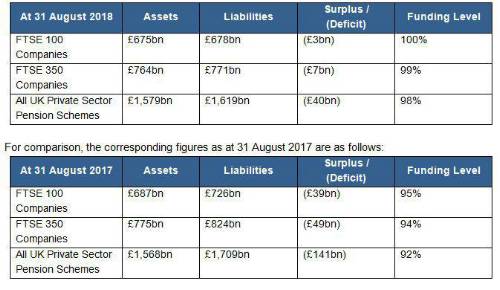

As at 31 August 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Chief Actuary, JLT Employee Benefits, comments: “Markets seem to be holding their breath as FTSE 100 pension schemes just slipped back into deficit, having broken into surplus last month for the first time in 10 years.

“The Bank of England did increase interest rates last month in a long anticipated and much signposted move. However, outgoing member of the Bank of England’s Monetary Policy Committee (MPC), Ian McCafferty, has warned that we should be expecting low interest rates for the next 20 years – and this is coming from possibly the most hawkish member of the MPC, who has long encouraged a rise in interest rates. As a result, a subdued market has seen long term interest rates drift slightly downwards this month with inflation rates remaining broadly unchanged.

“So, is this the calm before the storm? US equity markets continue to march ahead on the back of strong corporate profitability and tax cuts – with no one seeming overly concerned about rising debt levels. The UK market has been more circumspect, as equity markets have held up well, despite an unsettled political backdrop, but Brexit worries and trade fears are not far away. The current environment seems fairly fragile, and it does seem like it would not take much to spook markets and send asset prices tumbling.

“Many pension scheme trustees are currently looking at their triennial valuation results and reviewing funding and investment strategies. Trustees do tend to be more cautious when looking at their pension scheme valuations. However, many pension schemes are seeing valuation results which are an improvement on their funding position at the last valuation 3 years ago. There is the possibility that 2018 may see a welcome and much reduced demand for additional pension funding on employers.

“It should therefore be an ideal opportunity for pension schemes to lock in their position and switch out of risky assets into investments which more closely match their liabilities. Having spent 10 years clawing their way back into surplus, it would be a sad day for pension schemes if all that progress was lost in another crisis of confidence in markets.

“Finance directors and trustees alike should be actively assessing the many favourable opportunities now available to lock in their liabilities, possibly through the purchase of matching cash-flow driven investments (CDI), of which there are a growing number of options now available.

“Another way for many pension schemes to lock in their finances and reduce risk is through the payment of individual transfer values to members. For some pension scheme members, such transfers can be attractive given the introduction of pension freedoms over the last few years. At the same time, they can be very beneficial to employers and trustees alike, looking to shrink their pension liabilities and reduce their reliance on the employer’s balance sheet to protect members’ benefits.

“We therefore believe that the Pensions Regulator’s fears that overly generous transfer values could damage the interests of remaining members are unfounded. Indeed, we contend that most members of pension schemes would benefit significantly from a policy of more generous transfer values rather than cutbacks in transfer values. We hope and encourage the Pensions Regulator to change its position on such payments.”

|