Programmes across a number of different lines of business and geographies generally renewed closer to expiring levels at 1 January 2017.

Factors are interacting to create an environment of moderating rate reductions.

As reinsurance pricing remains at historically low levels, the value and efficiency of reinsurance capital is reinforced.

David Flandro, Global Head of Analytics, JLT Re, said, “Near-record levels of capital currently remain the dominant force in determining the direction of reinsurance pricing, as excess supply chases relatively muted demand. Nevertheless, moderating capital inflows, increasing cessions at the margin, the prospect of higher insured catastrophe losses, reserving volatility, inflationary and interest rate concerns and declining forward reinsurer returns are coalescing to push back against downward pricing pressures.”

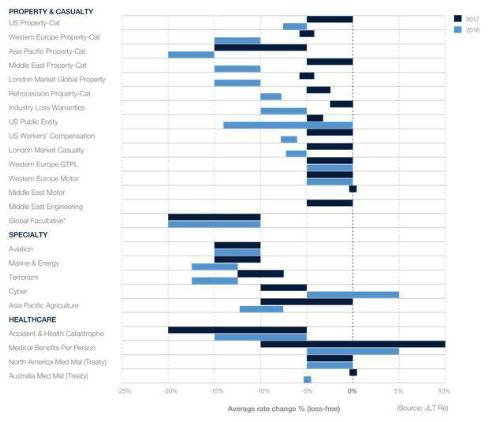

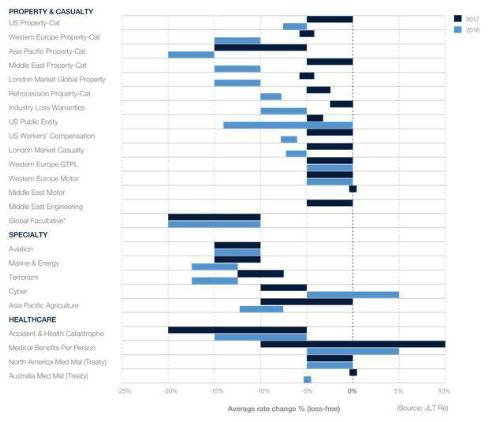

As Figure 1 shows, there was a broad trend towards moderating price declines across most business lines at 1 January 2017 when compared to the corresponding renewal in 2016. The full Renewal Retrospective Report provides in-depth perspectives for all lines of business listed below within the Property & Casualty, Specialty and Healthcare segments, along with analysis on the expected key issues for 2017.

Mike Reynolds, Global CEO, JLT Re, said, “Supply/demand dynamics are constantly evolving and there are early signs of a slight shift as capital levels have started to flatten whilst strategic reinsurance purchasing by some buyers has led to a subtle but notable uptick in demand in recent years. Reinsurers have produced returns well in excess of expectations over the last three years, due in large part to favourable reserve development and a sustained period of good fortune with low insured catastrophe losses. 2016 was a reminder that these tailwinds cannot be guaranteed in future years.”

Figure 1: Loss-Free Rate Movements by Line of Business at 1 January 2017

David Flandro concludes, “The challenges presented by reserving volatility, macroeconomic shocks or major losses (or a combination of all three) reinforce the value and efficiency of reinsurance capital in the current marketplace. Given that cession rates remain at historically low levels, now is the time for insurance carriers to re-examine reinsurance as a form of contingent capital. Evidence emerged in 2016 that this had started to happen as insurance carriers bought new quota share programmes, aggregate covers, excess of loss buy-downs and adverse developments covers (ADCs). Interest in multi-class and structured reinsurance products is also growing as cedents look to work with trusted markets to develop alternative and tailored solutions that minimise earnings volatility and secure competitive advantages.”

To view the full report please click here

|