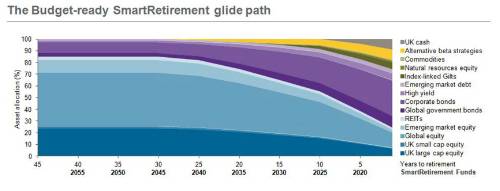

This diversification away from the SmartRetirement glide path’s historically more significant allocation to fixed income, as well as a slight increase in allocation to real assets as it approaches the target date, from 8% to 10%, reflects the expectation people may leave their assets invested in-plan for longer in the post-Budget pensions world, increasing the need for inflation-aware assets and return generation throughout the retirement period.

Source: J.P. Morgan Asset Management April 2015

UK defined contribution (DC) plans have typically glided members towards an asset allocation suitable for transitioning into an annuity purchase at the point of retirement. They often achieve this through a large allocation to fixed income, particularly 15-year Gilts, whose yields have historically moved in line with annuity rates. Now, with access to complete flexibility to determine their financial futures, member behaviour at retirement is likely to be much more disparate.

Simon Chinnery, Head of UK Defined Contribution at J.P. Morgan Asset Management comments:

“While there is great uncertainty in what members will now do at retirement and short term member behaviour is unlikely to be a strong indicator of future trends, it seems only prudent to remain diversified and flexible in our design.

“By incorporating more equities and inflation aware assets at the point of retirement, thereby maintaining diversified exposure to numerous asset classes, the SmartRetirement funds are able to provide an asset allocation suitable for a wider variety of behaviours. Shorter term demands for cash can be met out of the everyday liquidity required in a DC portfolio.”

Chinnery continues: “For those still keen on an annuity purchase, access to a diversified mix of assets – including large allocations to corporate and global government debt, along with equity and liquid alternatives, is actually more correlated to annuities that the old over 15 year gilt portfolio that existed pre April’s changes. And for those wanting or needing to stay in a Plan for longer, an asset mix which gradually de-risks to a lower volatile mix, reflecting both a more appropriate ‘holding pattern’ as well as ‘in-retirement’ portfolio.

“We have adapted our glide path to reflect the new realities facing investors. The current flux in the DC market is making it harder for plan sponsors to choose the right default solution for their members. One default that serves members by offering multi-asset flexibility and risk management should be will be able to ensure members are properly diversified and best equipped for whatever post-retirement choices they may make.”

|