But for most investors the pace of growth in Europe and the timing of the first US rate rise are going to be much more important, says Stephanie Flanders, Chief Market Strategist for Europe, J.P. Morgan Asset Management.

Offering insight into the current environment, J.P. Morgan Asset Management today releases its quarterly Guide to the Markets. The unbiased chart pack illustrates the most important market, economic and investment themes influencing the markets.

Key considerations for investors this quarter include:

The dollar: on balance, the strength of the greenback has been helpful to global growth. But a further race to the bottom on currencies could pose risks to global stability and the US.

Recovery in Europe: there are good reasons for investors to feel more optimistic about the Eurozone but we need to see corporate earnings perform well in order to match these higher expectations.

A murky outlook for the UK: political uncertainty could dampen investment and increase market volatility in 2015 but we do not believe it will throw the recovery off course.

US monetary policy remains top of the agenda for most investors

Investors entered 2015 feeling confident about the US economy and hesitant about the prospects for Europe. The mood has shifted since then, as news flow from the Eurozone started to turn positive and US corporates felt the pinch of a rising dollar. But the strength of the US recovery and the timing of the first US rate rise are still top of the agenda for most global investors.

“Our best guess is that the US central bank will raise its key policy rate in the second half of 2015. But its decision has been complicated by plummeting inflation, a rising currency and a slight pullback in US economic growth. The Federal Reserve would like to start the US on the road to higher rates but senior officials continue to believe the risks of tightening too soon are greater than the risks of tightening too late,” said David Stubbs, Global Market Strategist for J.P. Morgan Asset Management.

Federal Reserve policy-makers believe they can “look through” the fall in the inflation rate so far this year, because it has been caused by a fall in the oil price which should be a net positive for US growth. However domestic wage growth is still weak, despite continued strong jobs growth, and the strength of the dollar will inevitably put a dent in economic growth this year.

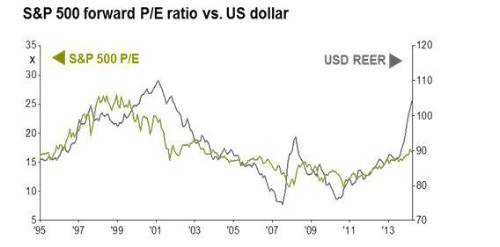

As the chart below shows, US stock market valuations have historically been positively correlated to the dollar. This shows that US equities can continue to move forward in this environment but also highlights the potential negative impact of the stronger currency on corporate earnings. In the last three months of 2014, the more domestically oriented companies in the S&P 500 enjoyed 10% growth in earnings but export-oriented companies only saw profit growth in the low single digits.

“As we highlighted at the start of this year, a period of dollar strength could be helpful for the global economy if it slows the pace of rate rises in the US, while supporting faster growth in Europe and Japan. But a further race to the bottom on currencies would be counterproductive for markets and global growth, as well as posing deeper problems for the Federal Reserve,” said Flanders.

Should investors buy into Europe’s recovery story?

Europe’s economy has surprised on the upside in recent months, with a surge in activity in Germany as well as signs of improvement in France and Italy. The European Central Bank (ECB) waited too long to start a full-scale programme of sovereign bond purchases, but if there was a good time to come late to the quantitative easing (QE) party, the ECB seems to have chosen it. Credit growth in the Eurozone has been positive since the start of the year and the fall in the oil price was starting to feed through to European consumers long before the formal start of QE.

Investors who bought into the Eurozone recovery story have been handsomely rewarded, at least in Euros. Every major Eurozone stock index recorded double digit growth (CHK) in local currency terms in the first three months of 2015.

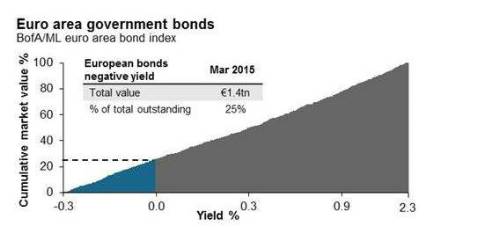

However, this outperformance shrinks dramatically if you translate returns into dollars or pounds. Both the fall in the Euro and the emergence of negative yields in many Eurozone bond markets are a reminder that Europe is still a long way from normal.

“A year ago, almost no Eurozone sovereign bonds were offering a negative yield, today they account for twenty five per cent of the market. The Eurozone is now at the epicentre of the global search for yield,” commented Flanders.

European high yield credit and relatively high yielding European stocks are likely to do well in this environment, as European savers and financial institutions seek alternatives to core “fixed income” products that are not offering any income at all. But with market valuations now higher than they were at the start of the year, investors in European shares will need to be increasingly selective.

“Whilst European stock markets have had an excellent start to the year, the Eurozone cannot recover through a weak currency alone, and political risks in Greece, Spain and elsewhere have not gone away. For the region to continue to outperform, investors will need to see evidence that growth is deepening and that corporate earnings are genuinely picking up,” said Stubbs.

UK stuck in the middle

Not so long ago, many thought the Bank of England might raise interest rates before the US. Now this seems deeply unlikely. Political uncertainty looms large over the upcoming general election and a plummeting inflation rate has pushed market expectations for the first UK rate rise further into the future. But with the UK economy still showing signs of healthy momentum and wage growth picking up investors would be misguided to assume that a 2015 rate rise has been entirely ruled out.

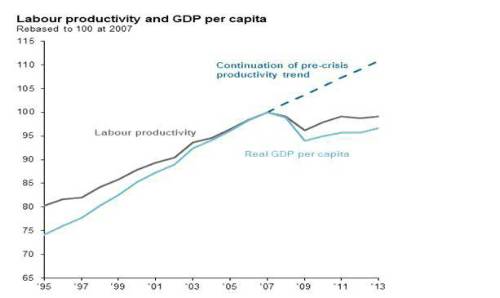

“Political uncertainty will dominate news headlines and likely cause market volatility in the months ahead but, for long-term investors, the foremost risks for the UK relate to its long run productivity growth and its continued membership of the European Union. Neither of these will be decided in the upcoming election,” said Flanders.

“The largest short-term concern for investors and the UK economy is arguably the pound, which has fallen sharply against the dollar but is reaching multi-year highs against the Euro. It is an uncomfortable combination for many major UK companies, though the fundamentals for the domestic recovery look stronger than many on the Continent,” said Stubbs.

Summarising the outlook, Flanders concluded, “Though sentiment has shifted in the first part of the year, there continues to be a large degree of consensus in markets and the main developed world equity markets are more expensive than they were. On balance, a pro-risk stance still makes sense but investors should be diversifying more – and expecting less.”

The full chart pack, Guide to the Markets can be downloaded below

|