Companies are reacting to the combination of challenging economic conditions, rising pension costs and onerous pension regulations by closing pension schemes to future and even current employees. JLT estimates that after allowing for the impact of changes in assumptions and market conditions, the underlying reduction in ongoing DB pension provision is approximately 15% over the last 12 months.

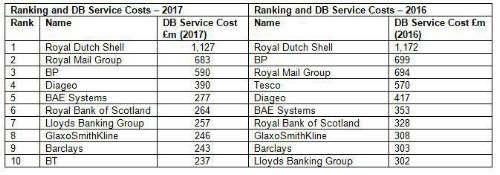

Looking at the top 10 companies with the highest ongoing DB service costs, 9 out of 10 have significantly cut back their DB service costs. Tesco closed its DB scheme in 2016, and BP has cut back its costs significantly, followed closely by BAE Systems, and Royal Bank of Scotland.

The impact of pensions on boardroom decisions cannot only be shown by the reduction of continuing DB provision to employees, but also by looking at the extent to which the pension scheme poses a material risk on the company. JLT’s research found that 11 FTSE 100 companies have total disclosed pension liabilities greater than their equity market value as at 31 March 2017. International Airlines Group, BT and Sainsbury’s have total disclosed pension liabilities almost double their equity market value.

In the last 12 months, the total disclosed pension liabilities of FTSE 100 companies have risen from £584 billion to £705 billion. A total of 17 companies have disclosed pension liabilities of more than £10 billion, the largest of which is Royal Dutch Shell, with disclosed pension liabilities of £73 billion. A total of 20 companies have disclosed pension liabilities of less than £100 million, of which 11 companies have no DB pension liabilities.

Charles Cowling, Director, JLT Employee Benefits, said: It is sad to see that we are now witnessing the final demise of DB pension schemes in the UK – at least in the Private Sector. They have simply become too expensive as an employee benefit.

A typical final salary pension scheme now costs employers more than 3 times the cost of 30 years’ ago, largely as a result of increased longevity and changing market conditions. A DB pension scheme that might have had an employer cost of 10% to 15% of payroll in the late 1980s now costs the same employer well over 40% of payroll – and that is before any allowance for the costs of paying for large deficits.

These costs come up for debate and negotiation at the time of each triennial actuarial valuation. In previous cycles, it has been the smaller schemes that closed the door on future DB benefits for all their members. Now it is the last few massive DB schemes that are closing down. Tesco closed its DB pension scheme in 2016 and Royal Mail is in the process of closing its DB pension scheme. Even the employers for the UK’s largest private sector DB scheme, the Universities Superannuation Scheme, have announced plans to close to all future DB benefits.

Employees in much poorer DC schemes will cast a jealous eye on those lucky individuals still enjoying DB benefits, reflecting not only on how many employers have had to channel the large part of their pension spend on propping up expensive DB schemes, leaving little left for their DC schemes, but also reflecting on how an increasingly large part of their taxes is paying for public sector employees to continue to enjoy the expensive luxury of a gold-plated DB scheme.

• COMPANIES CONTINUING TO CUT BACK SIGNIFICANTLY ON SERVICING DB SCHEMES

• 11 FTSE 100 COMPANIES HAVE PENSION LIABILITIES GREATER THAN EQUITY MARKET VALUE

• PENSION LIABILITIES ROSE 21% OVER 12 MONTHS TO £705 BILLION

|