♦ 54% of couples could be putting their partners' financial futures at risk

♦ One in ten women dependent on their partners in retirement

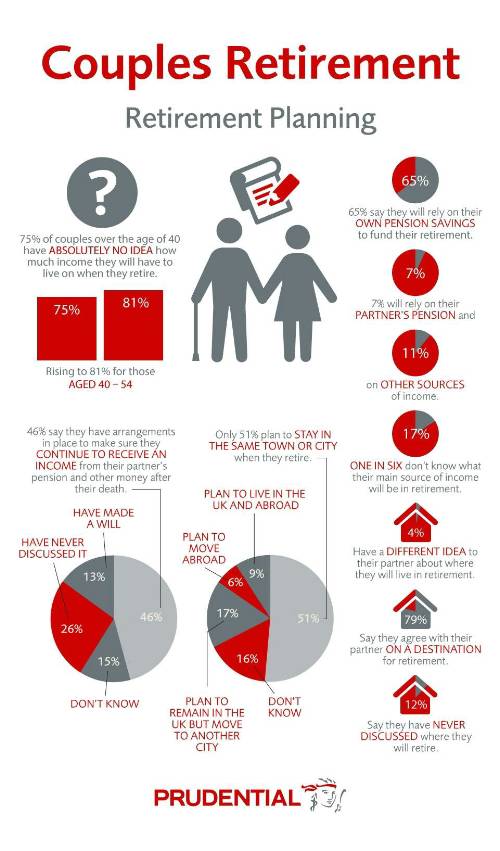

Less than half (46 per cent) of couples in the UK make joint retirement arrangements to ensure that, when they die, their partners will continue to receive income, according to new research from Prudential.

A study of 2,002 couples over the age of 40 reveals that one in four (26 per cent) couples have never discussed what will happen to their pensions if one partner dies before the other. Thirteen per cent admit that making a will is the only financial planning activity they have done together.

Seven per cent of those interviewed admit that they will be completely dependent on their partner's income in retirement. Women are twice as likely as men to be dependent on their partner in retirement, with 10 per cent planning to depend on their other half, compared with five per cent of men.

The research revealed significant confusion among couples when it comes to financial planning, with over one sixth (17 per cent) of respondents admitting to not even knowing what their main source of income will be in retirement. Almost two thirds (65 per cent) of respondents say they will rely on their own pension savings, while one in ten people (11 per cent) will look to sources other than pensions for their retirement income.

Vince Smith-Hughes, retirement expert at Prudential, said: "Saving as much money as you can from as early as possible should help to secure a comfortable retirement. However, if you are in a long-term relationship, retirement planning should be done together. Having an open conversation with your partner is the first step towards ensuring you make enough provision for each other.

"The fact that there is so much confusion among couples around retirement planning also emphasises the importance of seeking financial advice, to make sure you put in place the most appropriate retirement arrangements. Taking into account what benefits will continue after one partner dies is an important part of selecting the right solution."

The research also found that finances aren't the only uncertainty that couples will face in the run-up to retirement. Twelve per cent of couples claim they haven't even discussed where they plan to live when they retire. The majority (79 per cent) have done so, with just over half (51 per cent) intending to remain where they are. A further nine per cent plan to split their retirement between the UK and overseas, and six per cent plan to relocate abroad permanently.

Vince Smith-Hughes added: "If you're planning to retire abroad, it is important to check if this has any implications for your State Pension. For British expats, in many countries the State Pension won't increase annually in line with CPI, as it does if you live in the UK, meaning that over time its value will fall. It therefore pays to plan all aspects of your finances carefully before relocating."

Overall, 75 per cent of those polled claim they have no idea what their income will be in retirement.

|