*Data source: Employment, unemployment and economic inactivity for people aged 16 and over and aged from 16 to 64 (seasonally adjusted) –

Commenting on the figures, Stephen Lowe director at specialist financial services group Just Retirement, said:

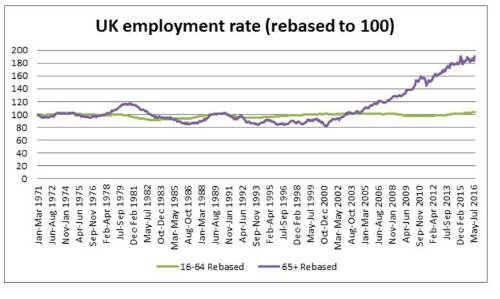

"We have known for some time that more people are working past the traditional retirement age of 65 than ever before. What these figures show is the extent to which the workplace is changing and the growing role people over 65 will play in driving the economy in 2017 and beyond. These figures appear to show that this trend was triggered in 2001, perhaps as a response to the dotcom crash, and has continued for 15 years with little sign of slowing.

“While there are many reasons people work past 65 some will be doing so out of financial necessity; as they continue to work generate the income to ensure regular bills can be paid each month. Following the changes to the pension rules there is the risk that some people may be tempted to withdraw pension savings but this may mean they end up working for longer. It is important that those who are considering retirement plans do not lose sight of the central purpose of a pension, which is to generate an income to replace the loss of wages when they stop working.

“Pension Wise, the government’s free, impartial guidance service is available to help retirees make informed decisions about how to access and use their pension savings, but it is not compulsory and those who choose not to use it or seek regulated financial advice face a myriad of difficult decisions by going it alone. The challenge for government policy makers, regulators and the pension industry is to encourage good decisions as people transition into retirement, overcoming the mistakes of the past that saw millions of savers fail to shop around and switch pension providers to ensure they attained the most competitive income in retirement.

“Given only one in five people are using Pension Wise there is a case for making it the default option, requiring people to opt-out rather than opting in, in the same way as auto-enrolment operates. It is essential that help is provided to increase the probability that people will make a good choice and attain the best value available. The current policy is not delivering that outcome.”

|