|

|

Legal & General today announced a year of strong performance of the assets held for their with profits policyholders with a return of 15.3% (before tax) for the 12 months to 31 December 2016. The company added bonuses worth £316 million to its with profits policies last year. This is lower than the £366 million added in 2015, reflecting a gradual reduction in the number of customers as policies continue to mature. |

Long-term returns continue to be well above inflation…

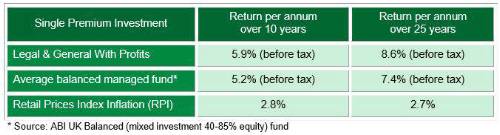

Over 25 years the assets held on behalf of Legal & General’s with profits policyholders have returned 8.6% per annum before tax and over 10 years the annual return is 5.9% before tax. This has exceeded the return on an average balanced managed fund and continues to be more than the average inflation rate over the same period, based on the Retail Prices Index (RPI).

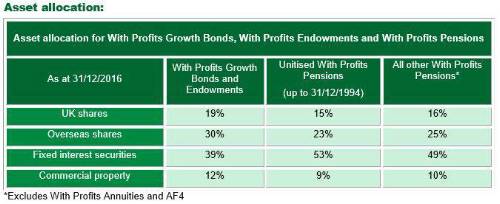

Commenting on our 2016 with profits performance Jackie Noakes, Managing Director Savings, Legal & General Assurance Society said; “Our with profits customers will benefit from a year of strong investment returns for 2016 of 15.3%. This clearly demonstrates the benefits for our existing customers of remaining invested in a fund with a broad range of assets. It also means that our with profits customers continue to see steady growth on their investments over the long-term, well in excess of inflation.”

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.