However, advisers are facing a number of difficulties as they integrate ESG into their investment propositions. Aegon’s report highlighted a degree of frustration among advisers at the lack of maturity of this market.

84% cite barriers to integrating ESG

84% of the advisers surveyed highlighted barriers to integrating ESG into their investment propositions. These break down into two main categories:

• Lack, or poor quality, of information

• Lack of product choice

Poor quality information

Despite the high level of interest, there is a clear lack of knowledge and understanding among both clients and advisers surrounding ESG. Only 2% of advisers felt their clients understood ESG well, with the remaining 98% citing a need for further education and improved awareness of the options available. 12% said their clients are overwhelmed by the choice available, while 28% said that their clients didn’t realise there were different types of approaches to ESG.

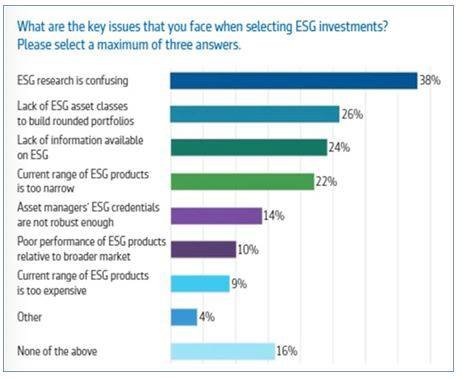

38% of advisers said they themselves found ESG research confusing, while 24% said they found a lack of information available on ESG. This points to a need for providers to improve, not only the quality of educational material on the subject, but also to better report on the solutions they offer in terms that are clear and accessible to all.

It also highlights a need for industry standardisation of ESG fund categories so advisers (and their clients) can more easily compare strategies. In this respect the Investment Association Responsible Investing framework, which sets out five key ways in which ESG can be incorporated within investments - ESG integration, stewardship, exclusions, sustainable and impact investing - could form a good starting point.

Poor product choice

26% of advisers said that the lack of ESG asset classes to build rounded portfolios made it difficult for them to fully embed ESG within their propositions. A further 22% feel that the current range of investment products is too equity focused and doesn’t offer their clients products that match their values and investment goals.

14% were sceptical of the ESG credentials of fund managers, 10% criticised the poor relative performance of ESG products and 9% felt that the higher costs of ESG were also a barrier.

Tim Orton, Managing Director of Investment Solutions at Aegon UK notes: “ESG is no longer an optional extra. There is a real opportunity to help advisers cut through the marketing messages so their clients can connect their savings with the ability to make an environmental or social impact.

“Our research shows that the industry is not moving fast enough in terms of clarity and consistency - which is a source of frustration for advisers and their clients.

“The government’s green finance agenda puts UK financial services at the forefront of this opportunity and as an industry we need to increase transparency so clients and their advisers can make informed decisions about their investments.”

|