Despite this lack of knowledge, two in five (41%) consumers do not pay attention to weather alerts as they don’t think their property is at risk of flooding even during the wetter winter months. At the same time, one in five (21%) say flooding is one of their worst fears in terms of property damage and with good reason as parts of the UK continue to battle the fallout from Storm Brendan last week.

When asked what they would do if their property was to experience flooding, the most common responses were to turn off gas, electricity and water supplies (84%) and move valuables to the highest floor of the house (83%) – a vital step in reducing flood damage. Three quarters (75%) would move family and pets to a high place with means of escape.

Cold weather do’s and don’ts

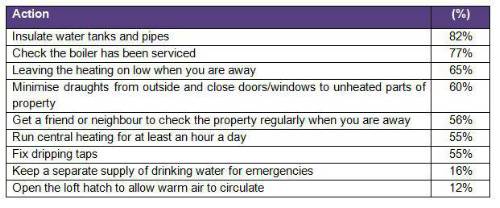

Another major threat to households in the winter is the risk of frozen or burst pipes during particularly cold spates of weather. To prevent this, the most common actions consumers would take include insulating water tanks and pipes (82%), checking the boiler has been serviced (77%), leaving the heating on while away (65%) and minimising draughts (60%).

However, just over half would get a friend or neighbour to check their property if away (56%), run central heating for at least an hour a day (55%) or fix dripping taps (55%).

Even fewer would keep a separate supply of drinking water for emergencies (16%) or open the loft hatch to allow warm air to circulate (12%). Worryingly, almost one in ten (7%) do not know where their property’s internal stopcock or valve is and how to close it, while 10% only probably know this.

Which of the following steps have you taken/would you take to prevent frozen or burst pipes in the winter?

Adam Powell, Co-Founder and Chief Operating Officer of Policy Expert, commented: “Cold and wet weather can wreak havoc on people’s homes during the winter months. So, it is in responsible insurers’ interests to ensure customers are as well prepared as possible to help prevent damage inflicted by wintery weather – not only to reduce the frequency or scale of claims, but as part of providing good overall customer service. From a customer’s point of view, having a poorly maintained home can impact the success of an insurance claim.

“While practical steps are always advised, they can be complemented with a tech-based approach. Policy Expert uses meteorological data to track weather patterns during wetter months and position flood responses – including Policy Expert first response vans containing exclusive super-dryers – in advance, minimising response time. We are also piloting the latest smart technology to detect potential damage as a result of cold weather, such as escape of water, before it becomes a serious problem.”

|