Acronyms are commonplace in the financial services industry. They play a role in shortening phrases and complex terms but for those outside the industry, including the millions of customers, they can often lead to confusion if not properly explained.

The financial regulator is introducing a new Consumer Duty – which will set higher standards in all parts of the retail financial services industry and make sure customers are receiving good outcomes. This acknowledges the need or clarity when it comes to communications, requiring firms to ‘provide timely and clear information that people can understand about products and services so consumers can make good financial decisions’.

To gauge the nation’s understanding, Aegon asked 2,000 adults (weighted to be nationally representative) to decipher common pension acronyms. We provided them with the acronym, and they had to write down what these meant.

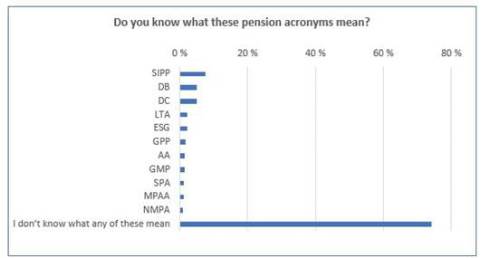

Overall, an overwhelming three quarters (74%) couldn't identify any of the acronyms tested.

Of the acronyms that people did understand, SIPP (Self Invested Personal Pension) was the most well-known, but even then, only 8% were able to tell us what this meant. A SIPP is a pension that allows you to save for retirement flexibly and can offer a wide range of investment options which individuals can manage themselves or through a financial adviser.

Also on the list was ESG (Environmental, Social and Governance). Sustainable investing and moving to ‘net zero’ has been a hot topic within the industry and was brought to the forefront last year with COP26 creating a focal point. However, when looking at the general population, only one in 50 (2%) of the people surveyed knew what words ESG stood for.

The full list of responses is below (see references below for meanings).

Aegon research, August 2022. 2,000 adults.

Steven Cameron, Pensions Director at Aegon, comments: “The financial services industry is not alone in loving an acronym, but that love isn’t shared by consumers. As the industry seeks to help people engage with their pensions and to deliver good outcomes, we wanted to test just how huge an understanding gulf there is. The results were eye opening with three quarters of people not knowing what a single one of the eleven acronyms tested meant. Our industry needs to take note!

“Providing clear and understandable communication is extremely important when it comes to explaining financial products and services. We shouldn’t underestimate the power of using every-day language as it can make a huge difference between confusing or helping people to better engage with their pension and make informed decisions.

“The financial services industry is very focused on demystifying pensions through communications designed to boost engagement and explain the basics. The first cross-industry ‘Pension Attention’ campaign has kicked off this autumn, including the annual Pensions Awareness Week, which should help to connect more people with their pension. Pensions can often seem daunting for those who don’t know where to start, so it is important that the industry cuts out confusing acronyms and truly engages with individuals with clear language.”

References

SIPP – Self Invested Personal Pension

DB – Defined Benefit

DC – Defined Contribution

LTA – Lifetime Allowance

ESG – Environmental, Social, Governance

GPP – Group Personal Pension

AA – Annual Allowance

GMP – Guaranteed Minimum Pension

SPA – State Pension Age

MPAA – Money Purchase Annual Allowance

NMPA – Normal Minimum Pension Age

|