According to the research, North American firms’ AUM were US$ 44.0 trillion at the end of 2015, a decrease of 1.1% from the previous year, while assets managed by European managers, including the U.K., decreased by 3.3%, to US$ 25.1 trillion. UK-based firms’ assets decreased 2%, reducing their AUM to US$ 6.6 trillion.

Luba Nikulina, global head of manager research at Willis Towers Watson, said: “The decline in global assets demonstrates the impact of the challenging investment landscape and currency fluctuations on asset managers across the globe. In 2014 our research showed a dramatic slowdown in growth, yet assets managed by the largest 500 managers still grew by just over 2%. This year the figures are markedly different. The economic slowdown has impacted investment performance. At the same time, asset owners are rethinking their business models by internalising asset management capabilities at the larger end of the spectrum and consolidating at the smaller and mid-size end which also has an impact on capital flows to the industry. This trend will continue to put pressure on revenues and require asset managers to further adapt to this challenging and continuously changing environment.”

The research, conducted in conjunction with Pensions & Investments, a leading US investment newspaper, reveals that actively managed assets, which continue to make up the majority of total assets (78.3%), also fell 2.8% in 2015, while passive assets declined at a faster rate, 5.5% during the year.

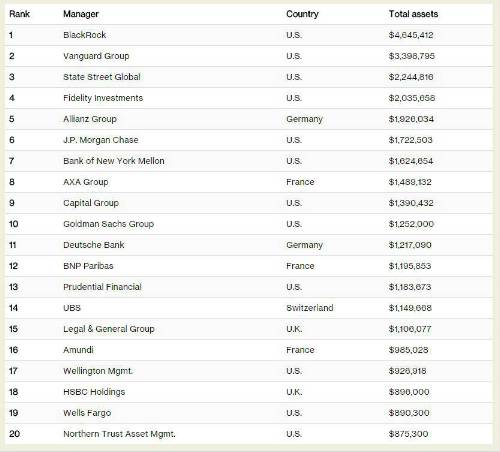

Although the Top 20 managers experienced a 1% decrease in assets from US$ 32.5 trillion to US$ 32.1 trillion, their share of total assets increased slightly from 41.6% to 41.9%.

The research shows that traditional equity and fixed income still make up the majority of all assets1 (78.2%: 45.4% equity, 32.8% fixed income), but they declined by 7.1% during 2015. The only stand-out category in terms of growth in 2015 is alternative assets which grew by 25.1%.

Luba Nikulina said: “The increase in alternative assets shows that in an environment of low returns and increased uncertainty, investors are under pressure to identify other means of achieving more diversity and higher returns. This shift in strategy is both welcome and essential if the investment industry is to adapt to meet its current and future challenges. However, the world of alternatives is much more complex than traditional bonds and equities so investors will need to focus on skill, holistic risk management and best in class implementation.”

The research also reveals that in the past ten years the proportion of asset managers from the U.S. in the Top 500 has increased significantly from 41.9% to 52.5%. Within the Top 20 in 2015 there were twelve US managers accounting for 69% of assets (up from 11 managers and 65.5% of the assets at the end of 2014). The remaining assets were managed by European firms.

Assets of the US Top 20 companies in 2015 increased 1.2% to over US$ 22 trillion in 2015, while assets of European Top 20 companies decreased 3.3% to just under US$ 10 trillion in the same period.

Some of the main gainers by rank in the top 50 (including through mergers or acquisitions) during the past five years include Aegon Group (+38 [63→25]), New York Life Investments (+28 [67→39]), Dimensional Fund Advisors (+25 [74→49]), Sumitomo Mitsui Trust Holdings (+22 [55→33]) and Standard Life (+21 [71→50]).

The world's largest money managers

Ranked by total assets under management, in U.S. millions, as of Dec. 31, 2015

|