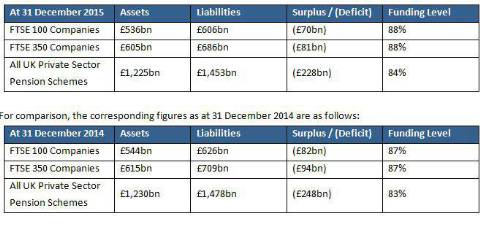

As at 31 December 2015, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments:“2015 has been another difficult year for companies with DB pension schemes. In particular, those pension schemes with actuarial valuations this year will likely have seen record high pension deficits and will probably still be negotiating on new funding and investment strategies. This could see some painful rises in company funding contributions coming through in 2016.

“The pensions industry has also seen this year the introduction of the new “Freedom & Choice” reforms. As of April 2015, members of defined contribution (DC) pension schemes now have the ability to cash in pension savings rather than buy an annuity. This has resulted in a surge of interest from members looking to transfer DB funds into a DC scheme in order to access their retirement savings. However, as of yet there has not been the flood of transfers that some predicted. This is partly because the market has struggled to provide suitable DC products to receive transfer values. It is also due to the market not being readily prepared for the burden of providing appropriate advice to individuals on reforms that the Government introduced at short notice.

“Looking forward, 2016 will see the end of contracting-out and further tax changes to pensions, namely the reduction in the annual and lifetime allowances. These changes mean that even with deficits and soaring costs aside, DB pension provision is looking less and less attractive in the private sector. We have already seen many large firms, from Tesco to United Utilities, close down or announce the closure of their DB pension schemes in 2015. It is no surprise therefore that we expect 2016 to be the year that, within the private sector at least, those last few companies still hanging on to their DB schemes will finally throw in the towel and switch over to DC entirely for employee pension provision.

“This final closure of private sector DB schemes means that 2016 will also see yet more end-game strategies – from liability management to buy-outs – all heading towards eventual wind-up.

“A recent interest rate rise by the Fed in the US may offer some hope that interest rate rises in 2016 will bring relief to pension schemes and DB deficits next year. But other economic indicators, in particular inflation and economic growth, along with Bank of England rhetoric, does not look promising for DB pension schemes relying on an early rise in interest rates. Indeed, we believe it is quite possible that we could go through the whole of 2016 without any interest rate rise. And with the added worry for markets of a possible positive Brexit vote, there is every possibility that 2016 will prove to be another very difficult year for DB pension schemes.

“There are therefore many reasons why companies and trustees should start 2016 by focusing on liability management, liability driven investments (LDI) and buy-ins / buy-outs. As a consequence, we believe that 2016 could be another record year for the buy-out market.”

|