|

|

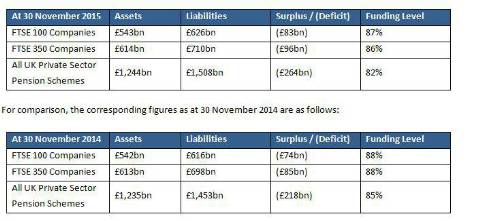

JLT Employee Benefits has updated its monthly index, showing the funding position of all UK private sector defined benefit (DB) pension schemes under the standard accounting measure (IAS19) used in company reports and accounts. |

As at 30 November 2015, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Deficits have widened again this month as the Bank of England has once again pushed back expectations for a rise in interest rates. Continued mild deflation is certainly not putting any pressure on the Bank to raise interest rates any time soon, nor do the economic gloom in Europe and the continued sluggishness of emerging markets.

“This is hurting UK pension schemes. In the last two months alone, the outlook for interest rates 18 months hence as reflected in market prices has fallen 0.5%. This has serious consequences because UK pension schemes still have a huge exposure to interest rates despite their significant activity in LDI and other hedging investment strategies. In effect, the UK pensions industry continues to take a very large position - some might even call it a bet - that interest rates will rise faster than the market expects. Trouble is, this is a position which month after month, since the start of the financial crisis, pension schemes have got wrong. Maybe it’s time for pension schemes to bite the bullet and stop betting against markets.”

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.