By Alex White, Head of ALM Research at Redington

For context, the largest annual move in 30-year real yields before 2022 was 1.2%. But this year, between Covid, Brexit and the war in Ukraine, there were plenty of inflationary pressures, causing the Bank of England to raise rates, with further hikes expected. This resulted in the largest annual move in 30-year real yields happening in the first six months of 2022. Then the mini-budget happened…

There’s a lot of commentary around what happened but, in brief, a strongly inflationary fiscal policy announcement against a backdrop of a deflationary monetary policy led the market to expect further rate rises, causing gilts to sell off. Pension funds hold gilts in LDI portfolios to protect against changes in interest rates and inflation. To enable some of their portfolio to be kept in growth assets, pension schemes often employ leverage within their LDI portfolios.

When gilts sold off, leveraged positions were hit harder. The collateral buffers within LDI portfolios were eaten up and pension schemes had to reduce exposure (by selling more gilts). The positions with the most duration (namely long-end index-linked gilts) were most hit. This is why break-even inflation fell materially on the back of inflationary news.

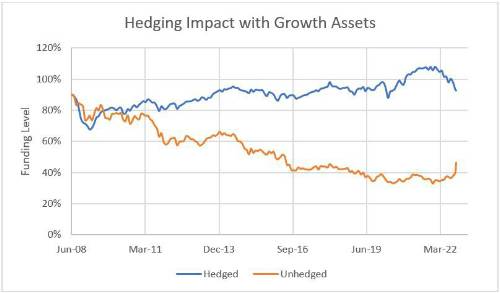

This sounds like a textbook crisis: participants used leverage, asset prices fell, and this triggered a vicious circle; but it’s not that simple. Gilts weren’t bad assets, and pension funds were right to run LDI portfolios. To highlight this, let’s look at a dummy scheme, with no contributions, under two scenarios: the first is with a funding level hedge, and the second is without any interest rate protection. We’ll start in June 2008, as that was when 20-year interest rates were most similar to what they were on October 12th.

The dummy scheme’s portfolio is as follows: 25% equity, 25% corporate bonds (interest rate hedged), 50% cash and LDI – noting that the big picture is not particularly sensitive to the mix of growth assets chosen.

Even ignoring recent material falls in rates, the differences in performance are vast. The hedged portfolio saw 0.2% growth in funding level with 7% volatility, while the unhedged portfolio experienced -4.6% growth with 12% volatility. Some of this higher performance has come from having more money invested in growth assets, but not all. A big part of the explanation is the carry that has been realised. That is, while the yield curve was upward sloping, the market priced in a near-term rise in rates for well over a decade as rates continued to fall, right until this year . Obviously this is only illustrative as it ignores contributions, but at a minimum, the unhedged scheme would have needed far more intervention from its sponsor.

Where some pension schemes will have encountered difficulties is where they had insufficient collateral. Under this scenario, pension schemes will have had their hedges trimmed when rates were at their highest, and therefore not had their full hedges in place as rates came down again. This will often have been a bigger problem for schemes with large pensioner buy-ins, as the residual liabilities would be higher duration. Ironically, too, those who attempted to match cashflows with investment grade-heavy cashflow-driven investing (“CDI”) structures may have had more significant cashflow problems, for precisely the reasons previously flagged in earlier articles , . Well-collateralized and ‘bar-belled’ schemes (with smaller holdings in higher-returning assets) will tend to have been less affected.

The way LDI works is changing, and more collateral will need to be held as a result. But I’d argue that while LDI may be changing, it isn’t dying. The most fundamental reason to do LDI is that earning 5% when gilt rates are 5% is easy, but when gilt rates are 1%, it’s hard – so schemes need more assets when rates are lower. That remains true. Therefore, however LDI may evolve, it still has a place in protecting against falls in interest rates, arguably the biggest first-order problem for DB pension schemes.

|