With auto-enrolment maturing, pension pots growing, and contributions set to rise further to eight per cent from April this year, the rapidly growing master trust will this summer move from its already low-cost AMC of 0.5% to a banded pricing structure. Member charges as a percentage, will fall as their pension pots grow, giving them a long-term incentive to stick with auto-enrolment saving and to consolidate multiple pots.

The new pricing structure immediately reduces the fee revenue which The People’s Pension receives from its membership’s Annual Management Charges (AMC) by 10 per cent.

An average earner saving over their working life with The People’s Pension could see their lifetime AMC fall by more than half to just 0.23%2, potentially increasing their pension pot at retirement by:

• almost £55 000 when compared to a lifetime fee set at the charge cap of 0.75% - nearly five years additional retirement income3

• almost £30 000 when compared to a lifetime fee set at the already low 0.50% which members of The People’s Pension currently pay - nearly three years additional retirement income4

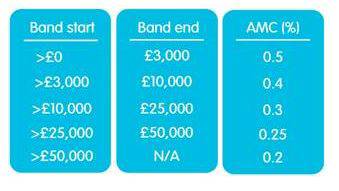

A member’s AMC will reduce as their savings increase through the following bands5, with the charge they pay shown simply and transparently in pounds and pence each month in their online account.

Commenting on this announcement, Patrick Heath-Lay, CEO of B&CE, provider of The People’s Pension, said: “Auto-enrolment is on the cusp of a significant landmark, with contributions set to rise for 10 million savers across the UK. Providers need to respond imaginatively to ensure auto-enrolment is attractive over the long-term, rewards people for saving and incentivises the consolidation of multiple pots.

“Charges can eat away at pensions, and on a flat-rate, percentage fee savers pay a lot more in pounds and pence the more they save. We’re reducing members annual charges as a percentage of their savings in line with the growth of their pot, potentially boosting their retirement income by thousands.

“The People’s Pension led the auto-enrolment market by offering all employers, whether large or small, the same uniform single charging structure for their employees, removing a sense of unfairness in industry charging practices. We’re taking this approach further by offering all members the same clear incentive to save for the long-term. We urge the industry to follow suit.”

Responding to the announcement, Guy Opperman, Minister for Pensions and Financial Inclusion, said: “With the completion of automatic enrolment and the next phase of contribution increases about to take place, I’m pleased to see The People’s Pension taking this action to improve value for money for its members. I’d encourage all firms to look at what they can do to ensure they keep delivering value as the amounts saved continue to grow.”

The organisation Amey, an infrastructure support service provider which uses The People’s Pension as its employee’s pension provider, endorsed the change:

“The reduction in overall annual management charge is a positive change that reflects The Peoples Pension’s ‘value for money’ approach to retirement provision. The new banded charging structure will improve our employee’s retirement outcomes because it encourages members to save more and reduces the cross subsidy between members with large and smaller pension pots.“

|