A survey conducted for the ABI found homebuyers were more likely to have looked into the ease of parking in the area  (33%) than checked whether their house could be at risk from flooding (28%).

With one in six homes in England and Wales estimated to be at risk of flooding from either rivers and sea or surface water, the ABI is urging estate agents and property websites to provide up-front information about flood risk, using a simple traffic-light style mark.

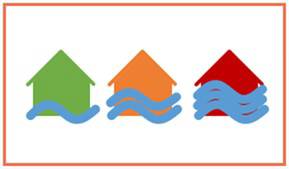

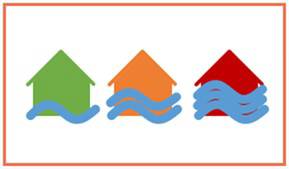

The ABI is today unveiling its proposed design (see picture right) and showing how the symbols would work for property adverts, in the same way Energy Performance Certificates do.

James Dalton, Director of General Insurance Policy at the ABI, said: "Flooding is a growing threat that as a nation we have to adapt to living with. As the floods of last winter reminded us, being flooded is horribly traumatic and can leave people out of their home or business for months. Anyone whose property is at flood risk needs to be aware of that so they can take steps to protect themselves.

"Property advertisements carry a wealth of information on everything from local schools to a property’s energy efficiency rating. Easily available information about the flood risk of the area is a glaring omission which needs to be put right."

Traffic-light warnings on flood risk for property adverts – how would it work?

-

In England and Wales, flood risk information broken down by postcode is freely available via online maps provided by the Environment Agency and Natural Resource Wales.

-

Each estate agent brochure and online property advert would carry a symbol marked red, amber or green to indicate the possible level of flood risk on each property advert, based on this postcode-wide information.

-

Househunters considering a property with an amber or red symbol should be prompted to take further action to investigate the specific property they are interested in. This could include paying for a full flood risk report, investigating any flood defences which are in place or due to be built, and finding out whether there are protection measures installed at the property or whether they could be put in.

-

Marketing materials for new build properties would be expected to use the same symbols.

At the moment, information about a high flood risk may only be uncovered during property searches as a house purchase is being processed. This information can come once someone has already spent hundreds of pounds on surveys and solicitors’ fees, and is part of a home-buying chain.

|

(33%) than checked whether their house could be at risk from flooding (28%).

(33%) than checked whether their house could be at risk from flooding (28%).