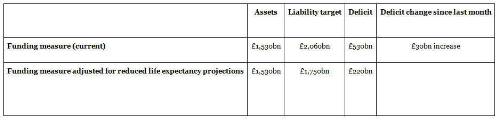

However, latest life expectancy analysis - from the Continuous Mortality Investigation (CMI) - shows that we are no longer seeing the same rates of improvement in life expectancy experienced at the start of the 21st century, and which underpin many pension scheme deficit forecasts. If the more recent trend continues, £310bn could be wiped off the aggregate £530bn pension deficit, leaving £220bn.

Furthermore, pension fund assets would need to grow by an extra 1% a year more than currently assumed in deficit calculations, for the next 20 years, to cover the remaining £220bn deficit without needing company cash contributions.

PwC’s Skyval Index, based on the Skyval platform used by pension funds, provides an aggregate health check of the UK’s c.5,800 DB pension funds. The current Skyval Index figures are:

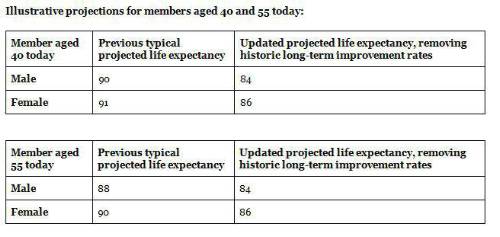

Raj Mody, PwC’s global head of pensions, said: “In the first decade of this century, there was a clear trend for improvements in life expectancy. Pension funds have typically been assuming this trend will continue when forecasting deficits. But over the last five year, that trend has changed and there is a growing view that it is not just a "blip".

“Any given pension fund will have to think about how the national data affects their situation specifically - that will depend on the composition of their membership relative to the UK population generally. However, £310bn could be shaved off pension deficits if the latest life expectancy trends are assumed to continue and allowances for previous long-term improvements are removed. That then puts a fuller funding situation within reach for many pension funds, without relying on excessive cash contributions to repair deficits in the short term. For example, if assets grew by an extra 1% a year than otherwise assumed when working out deficits in the first place, that on average would cover pension liabilities without the need for company cash contributions. Clearly the right strategy for each pension fund will depend on their specific circumstances.

“If pension schemes were previously assuming that a 40-year old man lives to 90, but that could end up being 84, you would look at current deficits in a different light. Companies and pension trustees should rethink their approach for how best to cover some very uncertain scenarios which aren’t going to become clearer for a few decades.”

|