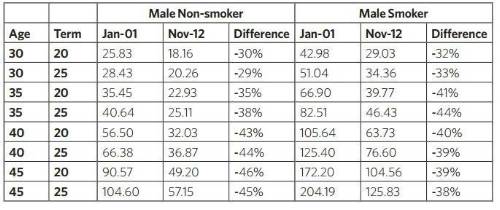

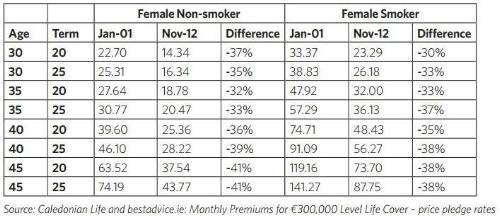

Consumers in 2012 can pay up to €24,000 less, over the lifetime of their Life assurance policies than those that took out the same cover in 2001, according to a market review carried out by Caledonian Life. The new figures released by the Protection specialists, show that over the last decade due to medical advances and lifestyle improvements which in turn, lead to an increased life expectancy, Life cover premiums have dropped significantly among most categories.

Greg Dyer Head of Sales and Marketing at Caledonian Life commented on the review:

“This is a good news story for consumers in these financially challenging times. We know that people all over the country are finding it difficult with so many demands on their income, so to know that price of Life cover has decreased to a decade long low, is something they should definitely welcome. Our analysis highlights the differences in the pricing of male & female policies over the years and both sexes have seen marked reductions in price over the last 10 years. Further changes will be coming soon too with the impact of the Gender Directive with these lower premiums for females coming under particular pressure.”

Other highlights from the market review include:

• The greatest percentage premium falls occur for non-smoking males in their 40s looking for life cover up to 65, where some premiums have fallen by over up to 46%.

• Smokers are still typically charged almost double the premium of a non-smoker.

Greg continued, “If we take a typical family situation of a 45 year old taking out €300,000 of Life cover up until they are age 70, then we can see the following reductions over a 10 years period for the various demographics.”

A male non-smokers premium is down 40% from €104 to €57 per month, a saving over €14,000 over the full term of the policy.

• Male smokers now pay 38% less over this period, with some premiums in the examples above, down

from €204 to €125. This would equate to a staggering saving of over €24,000 over the full term.

• The corresponding drop for a non-smoking female is €74 to €44 per month a fall of 41%

• And a female smoker’s premiums have reduced from €141 to €88 per month – down 38%

Greg concluded, “This market review highlights the fact that greater competition, increased efficiencies by Life companies, greater longevity, coupled with increased competition and a more price savvy consumer has brought about significant price decreases over the decade. Your local Financial Broker will be delighted to help you find the best policy at the best price to meet your needs.”

|