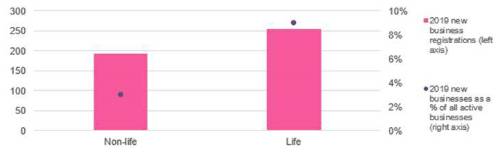

A total of 256 new life insurance businesses were registered with Companies House in the first eight months of the year. This represents nearly one in ten (9%) of the total 2,884 active businesses in the life market.

In contrast, 195 general insurance (GI) start-ups were registered between January and August, despite the total market being almost twice the size with 5,703 active firms registered.

New ventures established in 2019 comprise a much smaller part of the non-life market, accounting for just 3% of active businesses compared to 9% of life firms.

Graph 1: Life market outpaces non-life for new business creation in 2019

Two new insurance ventures registered each working day

The UK market has seen a total of 390 new insurance businesses registered so far this year¹, which equates to one in twenty (5%) of the 7,449 insurance companies currently active.

With 170 working days between 1st January and 31st August, this means more than two (2.3) new insurance ventures have been registered on a daily basis over the last eight months.

This suggests that new insurance businesses incorporated in 2019 will soon outnumber their predecessors in the ‘Class of 2018’. There are currently 452 new insurance businesses registered from 2018 that are still active: just 62 more than the new 2019 cohort with four months – including 85 working days – of the year still to go.

Challenging conditions drive drop-out rates

However, Policy Expert’s analysis also highlights the challenging operating conditions in today’s market. Over the last year, there has been a 28% drop in the number of insurance businesses incorporated in 2017 that are still active – falling from 467 last summer to 338.

Similarly, nearly one in five (19%) insurance ventures established in 2016 have disappeared over the last year, with just 251 still registered as active – down from 310 in summer 2018.

These figures are likely to be influenced by a range of corporate changes including mergers, acquisitions, dissolutions, liquidation, insolvency and administration.

Adam Powell, Co-Founder and Chief Operating Officer of Policy Expert, commented: “The insurance start-up market continues to grow in 2019 with life insurance new business ventures outnumbering their non-life counterparts by almost a third.

“The founders of these new ventures need be optimistic, but realistic about their future prospects. Establishing an insurance start-up is a completely different prospect to scaling it into a fully-fledged business that becomes a permanent fixture in the landscape. While 2019 has seen plenty of new ventures come to market, it has also witnessed the failure of some high-profile names in the insurtech world.

“New insurance companies are fighting one another for scale. They have to apply their technology, acquire and maintain customers, and drive growth just to remain competitive. Often, insurtech start-ups fail because they are unable to be agile and flexible – both in their approach to technology and how best apply it, but also distribution.

“As we have found on Policy Expert’s journey from start-up to scale, there is ample opportunity to disrupt stagnant areas of the insurance market and deliver better customer propositions. But ultimately, good ideas run the risk of a premature end unless they are backed by a realistic growth plan to achieve success.”

|