By Scott Eason, Head of Insurance Consulting at Barnett Waddingham

Solvency II and liquidity investing for insurance

Solvency II introduces fundamental changes to the capital treatment of liquidity investments. Cash is not a ‘risk free’ asset and treasury teams should recognise there are also differences between the Solvency Capital Requirement (SCR) necessary for cash deposits held at a bank, versus other short-dated money market instruments.

The Solvency II standard methodology assumes the loss given default for cash held at a bank is 100%. The reason for this is based on a logical assumption that if the bank were to default, the entire cash holding will be written down to zero.

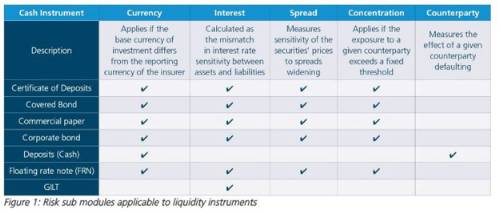

The counterparty risk sub-module is therefore the main driver of investment risk for deposits, while other cash instruments are covered by the market risk sub modules – such as currency risk, interest rate risk, spread risk and concentration risk.

We have estimated, for typical cash instruments, the amount of solvency capital required under the standard formula on an asset only basis (see figure 2).

Methodology: Analytics are based on Barnett Waddingham’s interpretation of the Solvency II Standard formula

Interest rate risk is excluded: This is a delta NAV calculation and is dependent on the duration of the underlying instruments offset by liabilities; therefore it is not practical to consider interest rate risk on a stand-alone basis

Currency Risk is excluded: An assumption is made that all securities are in the reporting currency therefore no currency risk is incurred. Concentration risk is excluded: This applies across all holdings on the balance sheet. We assume these investments are in a well-diversified pool of assets across the insurer’s balance sheet.

Keeping all other factors neutral and focussing on spread risk and counterparty risk, the chart above shows how risk capital for deposits is significantly greater than using market traded securities.

Optimal strategy

In most cases, liquidity funds aim to target an uplift of 50-100bps over cash deposits by investing in assets with an average maturity of 6m-2y.

Given that the SCR on these funds is typically lower than for cash deposits, we can see that switching a proportion of assets from cash deposits to liquidity funds should be optimal.

The amount to invest, and the funds to consider, will depend on your cashflow projections and your appetite for liquidity risk. We would be very happy to help you assess your needs and the potential opportunity to improve return on capital.

|