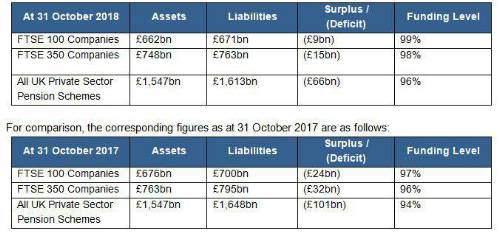

As at 31 October 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Chief Actuary, JLT Employee Benefits, comments: “The big news in pensions this month is not the Budget, which was unusually quiet on pensions, but rather the judgement last week in the Lloyds Banking Group case on GMP equalisation.

This may be a very technical case which will mean little to most members of pension schemes or, indeed, to anyone other than pension experts, but it could have huge implications. It confirms what has been long known, but ignored by many pension schemes, which is that the elements of pensions known as GMPs contravene gender discrimination rules. This is going to mean that pension schemes are going to have to recalculate benefits for millions of members.

“To make matters worse the calculations are fiendishly complicated and could incur huge additional costs and resources. Indeed, for many pension scheme members, the cost of doing the calculations alone could be much greater than the cost of the additional benefits that may be awarded.

“We estimate that as a result of this case, the pension liabilities on the balance sheets of the FTSE100 are likely to increase by approximately £12billion. More significant for finance directors is that there is a risk that auditors will require these costs to be a hit to reported profits. Across the whole of the UK we estimate this could hit the profits of UK companies by £32billion.

“We argue that as this Lloyds Banking Group case only confirmed what was already a legal requirement, nothing has changed - other than we now know how the courts want us to do the calculations. This cost should therefore go through company accounts as an ‘actuarial loss’. But the major audit firms may think differently - they are currently discussing the options and hoping to come to a consensus view on their preferred accounting treatment.

“But it is not just finance directors who will be hoping that the audit firms conclude this does not need to impact company profits. If the audit firms do decide to hit company profits, it could see £6bn wiped off the Government’s anticipated corporation tax receipts. In turn, this could see Chancellor Philip Hammond having to redo his Budget calculations only days after presenting them to the nation.”

|