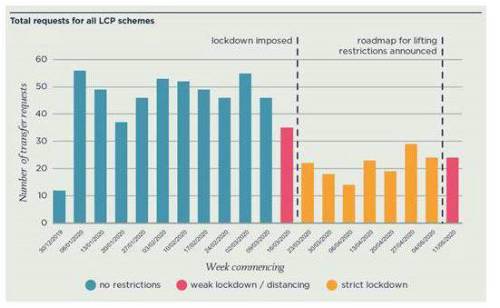

The chart shows volumes of transfer requests on a weekly basis since the start of 2020 for the schemes administered by LCP. The impact of the lockdown can be clearly seen, as well as early signs of a recovery in volumes.

The chart also shows that initial fears of a surge in transfer activity associated with scams have not so far been borne out - though this does not mean that individual schemes may not have been targeted.

Looking back to before lockdown, the first quarter of 2020 had actually seen a relatively high volume of DB transfer inquiries, up 20% on the previous quarter and back to the levels of a year earlier. But the latest data on take up of transfers, which reflects the proportion of those receiving quotations six months ago who then went on to transfer, shows that ‘take-up rates’ were well below historic levels. Actual transfer activity was increasingly concentrated on the over 55s, with around three quarters of all amounts transferred being for this age group.

In terms of future trends, a combination of factors could lead to more scheme members seeking transfer quotes, including:

• The ending of ‘furloughing’ arrangements with some scheme members losing their jobs;

• Households running down savings balances and needing alternative sources of short-term finance;

A key issue for later in the year could be ensuring members can access affordable, high quality financial advice, especially if the FCA goes ahead with its delayed plans to abolish ‘contingent charging’ for transfer advice.

The report also found that:

• Around one quarter of schemes had suspended transfer quotations following the lockdown, in line with easements from the Pensions Regulator, though several of these have already resumed issuing quotations;

• Over the latest year, the average value of a completed DB transfer was £409k and the average age of a person transferring was 56.

Commenting on the latest data, Bart Huby, partner at LCP said: ‘We have seen the beginnings of a ‘u’ shape of activity around DB transfer inquiries so far this year. After a busy first quarter there was a clear ‘lockdown effect’ as interest in potential transfers dropped sharply. But in more recent weeks there are signs of a recovery in interest in transfers. It is possible that we may see a much higher level of inquiries later in the year as household budgets come under greater pressure, and the Pensions Regulator has warned trustees that they need to watch out for unusual or concerning patterns of transfer activity.’.

Clive Harrison, partner at LCP, added: “A key challenge will be to ensure that scheme members can access balanced and affordable advice, especially if they are motivated by short-term financial pressures. It is also important to ensure members are aware of all their pension options as most schemes allow early retirement from age 55. We’re likely to see more trustees looking to improve communications and appoint an IFA firm to provide their members with the support they need.”

|