Following the Government’s announcement of a Pensions Review, which will assess the adequacy of the nation’s long-term savings as well as how this money is invested, new analysis from Standard Life, part of Phoenix Group reveals the positive impact that increasing minimum auto-enrolment contributions could have on people’s pension pots.

Auto-enrolment (AE), the requirement for all employers to provide a workplace pension scheme and enrol all eligible employees, will have been in place for 12 years by October and the scheme has brought millions of people into pension saving. However, while it’s important any decisions take account of the short-term priorities of both employees and employers, increasing minimum contributions could improve the prospects of UK workers and ensure they are on course for a more comfortable retirement.

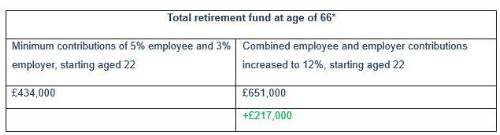

For example, Standard Life’s analysis finds that someone who began working full-time with a salary of £25,000 per year and paid the current minimum monthly AE contributions (5% employee, 3% employer) from the age of 22, could amass a total retirement fund of £434,000 at the age of 66*, not adjusted for inflation. However, if standard AE contributions were increased from 8% to 12% (e.g. 6% employee, 6% employer) from the age of 22, they could accumulate as much as £651,000 by the age of 66* – £217,000 more than the current standard contributions could achieve.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

The calculations show that extending AE could have a potentially transformational impact over the course of a career. It's worth noting that there are many people who started saving via auto-enrolment later in life, and so will have less time to build a pot. They could see an even greater relative benefit of higher minimum contributions as they look to secure a liveable income in retirement with less time to save.

Gail Izat, Managing Director for Workplace Pensions at Standard Life said: “It’s great to see the Government include savings adequacy in the second part of their Pensions Review. As we approach auto-enrolment’s 12th anniversary, it’s important to celebrate the achievements of the scheme while acknowledging that we need to do more to help people secure a decent standard of living in retirement. Our calculations show that raising minimum contributions could be a powerful way of setting people up for pensions success and future financial wellbeing, benefiting both employees and businesses in the long-term.

“In other countries like Australia, where minimum contributions are set to reach 12% from next July, higher contributions have led to greater savings adequacy and a higher anticipated standard of living in retirement than the UK.”

Patrick Thomson, Head of Research Analysis and Policy at Phoenix Insights, Phoenix Group’s Longevity think tank, comments: “As many as 17 million UK adults are not saving enough to retire when they want on the income they want, so a plan to increase minimum auto-enrolment contributions is crucial to addressing widespread under saving. Auto-enrolment has been an important policy to boost pension participation, but the current minimum rate is unlikely to provide most people with enough savings to achieve the income in retirement that they want or expect.

“Engagement with pensions is low and there is a risk that people are lulled into a false sense of security that the statutory contribution rate will provide enough savings for their retirement needs. We hope the Government’s review of pension adequacy will pave the way for an increase to minimum contributions when the economic conditions are right.”

|