By Gareth Haslip, Head of UK Strategy, Global Insurance Solutions at J.P. Morgan Asset Management

Under Solvency II, the FLOAR requires that insurance companies undertake a rigorous assessment of the risks facing their business on a forward looking basis, whereby the balance sheet of the insurance company is projected into the future in line with the firm’s business plan The insurer must demonstrate that they have considered possible relevant adverse scenarios

over the projection period.

Examples of stress events that might be included in the scenario analysis are (i) deteriorating claims ratios, (ii) catastrophe scenarios, (iii) investment losses, and (iv) operational losses. In each scenario, the insurer is required to quantify their losses, assess the loss absorbing capacity of their capital, and identify possible risk mitigating measures.

Beyond scenario analysis, the insurer must also demonstrate that on a forward looking basis, they have sufficient capital to cover the Solvency II capital requirements under their business plan. Additionally, during 2015 80% of the market is required to demonstrate continuous compliance with the Solvency II capital requirements, and identify any deviations between their

own risk profile and that assumed under the Standard Formula.

It should be noted that the FLOAR requires a great deal of input from management reflecting the interaction between the FLOAR and the firm’s business plan. While the European regulator (EIOPA) has not yet fully specified the requirements of the FLOAR, there are many sources of relevant guidance that indicate the likely scope of what national regulators will expect of insurers’

submissions2.

Projecting the Insurance Balance Sheet

-

In assessing the future solvency position of an insurance company, a number of considerations are relevant to the FLOAR:

-

The business plan of the insurer. This should be fully consistent with the board’s vision for the business over a three to five year time horizon, and comprehensive in its coverage of underwriting activities, investment strategy, and risk mitigation (e.g. hedging and reinsurance)

-

Estimates of future underwriting and investment performance, and reinsurance pricing; Computation of Solvency II capital requirements during the projection period of the business plan to demonstrate capital adequacy

*Selection of suitable risk measures and stress scenarios (including reverse stress tests) to test the robustness of the firm’s business plan, and identify events that would cause difficulties

While firms are not required to have an internal model for the FLOAR, there is a reasonable degree of financial modelling required to meet its requirements. Specifically, in order to assess whether the Solvency II capital requirements are satisfied in each year of the proposed business plan, it is necessary to develop a suitable forward looking model to project the insurer’sfinancial statements.

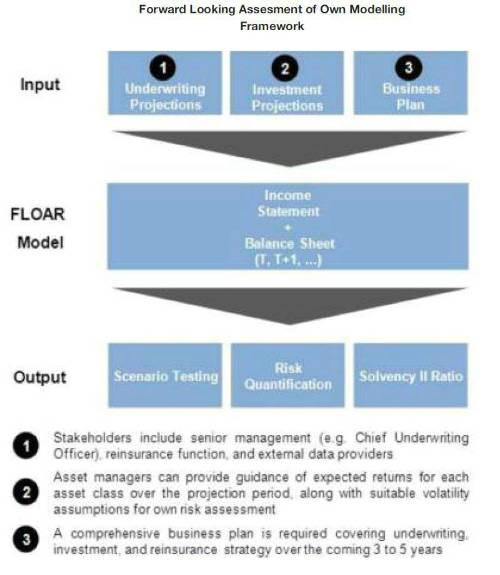

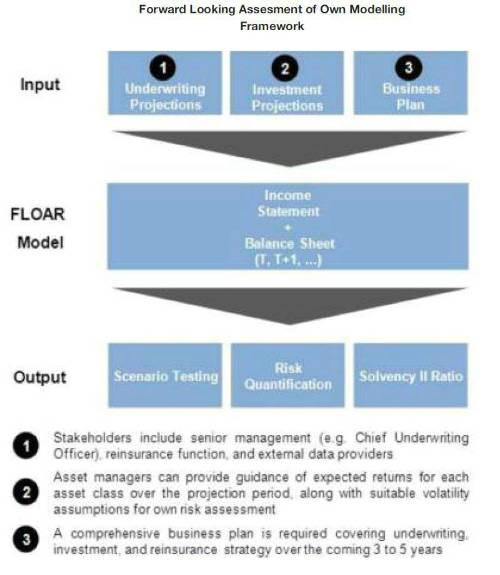

In Figure 1, we summarize the key inputs and outputs of a FLOAR model, and the key stakeholders involved. The first stage of developing the model is to obtain suitable underwriting and investment projection assumptions which may involve working closely with third parties, such as asset managers, reinsurers, and data providers.

For example, asset managers can provide projected investment returns over selected time horizons, conduct stress tests to calculate the potential investment losses during periods of market turbulence, and provide investment risk parameters that can beused to assess a forward looking view of investment risk3.

The income statement, balance sheet, and cash flow statement can then be projected over the time horizon of the firm’s business plan, facilitating the assessment of financial strength under a range of stress scenarios covering underwriting, investment, and operational risks to the business. Beyond the regulatory uses of the FLOAR model, it can also be a valuable tool for decision making, enabling insurers to test the impact on risk, capital, and profitability of proposed changes to underwriting and investment strategies. Some examples of using the FLOAR to aid decision making include:

-

Under a proposed underwriting and investment strategy, the FLOAR model can be utilised for calibrating the firm’s dividend distribution policy to maintain a target Solvency II capitalisation ratio over time (by retaining sufficient earnings in future years)

-

Using the FLOAR for reviewing the output of the strategic asset allocation process provides senior management with a transparent framework for assessing the potential impact of investment strategies on the level of profitability, risk, and capital at the enterprise level in the context of their overall business plan

The FLOAR model is a valuable tool for senior management to gain additional insight into the forward looking risks implicit in business plans, providing additional validation for proposed business strategies. Understanding the forward looking risks in your business and the robustness of a business plan is a very helpful exercise, and provides insurers with a rare opportunity to extract value from their Solvency II investment.

1 See “Own Risk and Solvency Assessment”, NAIC, 25

2 November 2014 2 For example, see “Solvency II Own Risk and Solvency Assessment

Guidance Notes, Lloyd’s, May 2012 and “NAIC Own Risk and Solvency Assessment Guidance

Manual”, NAIC, July 2014

3 Expected returns, volatilities and correlations of asset classes are provided in the “Long Term

Capital Market Return Assumptions 2015”, JPMAM

|