This assumes an employee and employer pension contribution rate of 5% each under a salary sacrifice payment system. For a small business employing only 10 people at that salary it would cost nearly £5k -a substantial hit to their bottom line and ability for growth. While National Insurance Contributions (NICs) relief provides an attractive option to plug the ‘black hole’ in the Treasury, the Chancellor should be wary of hiking up costs for employers, warns the leading pensions and financial services consultancy. This would be bad news for employees and could result in a reduction in pay rises and pension contributions.

Even a more modest change of NI relief to a 6% rate rather than the full 13.8% would still add a bill of £192 a year for the employer of that same employee, calculates Hymans Robertson. Changes in NI on employer pension contributions, and other potential adjustments impacting tax on pensions that have been predicted in the upcoming budget, are outlined by the firm in its latest paper.

Commenting on the implications for employers if NICs are to rise, Hannan English, Head of DC Corporate Consulting, Hymans Robertson says: “As we approach the budget with less than two weeks to go, the question of how the Chancellor will balance the books has never been more prominent. Rumours of cuts to National Insurance relief are headline news and the implication for employers is vast. Our concern is the impact this may have, where the current national insurance saving is used to top up pension contributions. Without this saving the top up is under threat. Abolishing such a saving would impact future pension pots at a time when pension savings, pensioner poverty and future proofing is at a record low. Our paper explores the wide range of speculation around tax and pensions that could be announced by the Government in the budget and what this means for individuals and employers".

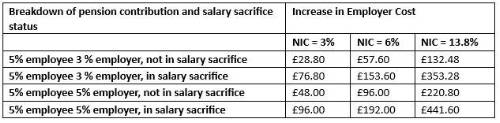

The table below sets out possible rises on employer NICs to their employees' pension pots. It considers different pension contribution rates from the employer, and whether or not an employee is under the salary sacrifice payment system. The first two rows set out the minimum employee and employer pension contribution rates under the auto-enrolment pension system: 5% employee and 3% employer. The following two rows consider the costs to a more benevolent employer, who equals their employees 5% pension contribution rate.

The three columns of NIC at 3%, 6% and 13.8% represent the amount of NIC relief lost, on the basis that a phased approach to removing NIC relief may be taken by the government.

|