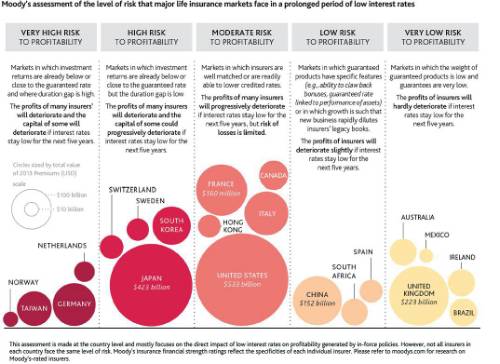

In a new report, Moody's reviewed 21 large life insurance markets and classified them according to their vulnerability to low interest rate risk. According to Moody's, life insurers in Germany, the Netherlands, Norway and Taiwan are amongst the most exposed to interest rate risk, while companies in Australia, Brazil, Ireland, Mexico and the UK are the least exposed. Moody's notes that not all insurers in each country face the same level of risk, but there are similarities among companies operating in the same market.

Moody's report, titled "Low Interest Rates are Credit Negative for Insurers Globally, but Risks Vary by Country," is available on www.moodys.com.

"We expect global interest rates to remain low by historical standards, so new money and maturing assets will be reinvested at yields that are lower than current portfolio yields. As a result, life insurers' investment returns will continue to decline for many years," says Benjamin Serra, a Moody's Senior Credit Officer and co-author of the report.

Insurers' vulnerability to low interest rates is typically determined by their business mix, the level of guarantees offered, their ability to share the impact of declining interest rates with policyholders, and the gap between the duration (the average time to maturity) of their assets and that of their liabilities.

According to Moody's, markets in which investment returns are already below or close to guaranteed rates and where the duration gap is high are the most exposed markets. Moody's expects profits of many insurers to decline and the capital of some insurers to deteriorate in these markets, if interest rates stay low. Conversely, markets in which the weight of guaranteed products in insurers' balance sheets is low and where the guarantees are low are the least exposed markets.

However, low interest rates also hurt insurers' sales or new business margins indirectly, which will also affect their profitability.

Moody's says that insurers are acting to counter the risk of low interest rates, particularly by lowering credited rates on in-force policies and reducing guarantees on new business. They are also changing their business mix by diversifying into health, protection, unit-linked products or asset management, and modifying their asset allocation. Some of them are hedging interest rate risk through derivatives.

"Insurers are in very different stages of implementation of these measures. In Japan, insurers have lowered credited rates, lowered guarantees on new business and diversified into health/protection with relative success in many cases. Similarly, some Dutch and German insurers have implemented long-term hedging strategies in the mid-2000s, before interest rates started to decrease rapidly, which helped reduce their vulnerability and differentiated them within their local markets," adds Mr Serra.

To download the full report please click on the pdf below

|