By Patrick Bloomfield, Partner at Hymans Robertson

Chris Arcari and Laura McLaren (our resident actuarial and investment experts) gave practical tips for post-COVID-19 economic scenarios and how to crack on with valuations in the current circumstances.

You can listen to the full recording here. In the meantime, here’s the points I took away from chairing the session and putting your questions to our panel.

Deal with the realities of COVID-19

David was clear that trustees and sponsors need to recognise the fundamental shifts that COVID-19 has caused. It’s OK if decisions need to wait until there’s a clearer picture on the sponsor’s future. Whilst there’s uncertainty, TPR is encouraging trustees to develop some different scenarios of how COVID-19 could play out and refine these scenarios as clarity emerges.

TPR’s realism also extends to trustees working with sponsors to set contribution plans that are affordable. The important caveat is that affordable plans should be flexible, so that schemes are treated fairly and a quicker than expected sponsor recovery flows through to restoring higher contributions that might otherwise have been agreed.

Focus and intensity of how you look at your sponsor covenant

Richard’s insights on covenant pointed to deeper understanding of where value is in a business being needed and monitoring the things that matter with appropriate frequency and intensity.

He covered some great questions like how to get a handle on whether executive remuneration is excessive and whether deferring contribution could make your scheme ineligible for the PPF. I expect many listeners were left with the sense that they may need to take professional covenant advice, when they previously may have not.

Practical scenarios to begin thinking about

Markets have been on a rollercoaster this year. Equities peaked in February, then fell sharply in March when COVID-19 hit Europe and have rebounded somewhat since.

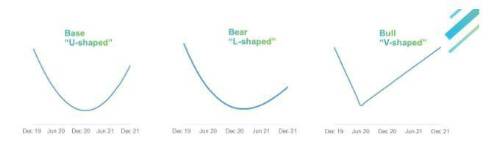

Our Capital Markets expert, Chris Arcari, provided these three scenarios for the future economic recovery:

Base-case “U-Shaped”: Severe downturn followed by gradual recovery as restrictions are loosened. An absence of meaningful COVID-19 medical progress leads to consumer spending and business investment remaining subdued. Equity markets drift lower and credit spreads remain elevated.

Downside (Bear) scenario “L-Shaped”: Infection rates increase following the relaxation of containment measures. This creates a prolonged economic shutdown across major economies, an extended recession and weaker recovery. Equity markets could reach new lows and bond yields could approach zero.

Upside (Bull) scenario “V-Shaped”: A vaccine and/or significant advancement of test & trace enables a sustained economic reopening. Pent-up consumption, production and business investment leads to a sharp recovery in economic output; accelerated by fiscal and monetary policy. As a result, equity markets and yields rise both and credit spreads fall.

Key actions for trustees and sponsors:

Laura wrapped up with these action plan pointers for those doing valuations at the moment.

Don’t change your valuation date – Since we should all be thinking about the current situation, there’s little merit in bringing forward a valuation date. TPR has warned trustees to think very carefully before this.

Defer big decisions – Although you should get started on routine work, we recommend holding off major decisions until there is more clarity emerges. This could be fairly soon, as we begin coming out of lockdown

Short term adjustments to reach long term targets – Good strategies don’t change their target just because of a bump in the road, they find a way to adjust and recover in the short to medium term. Trustees should be looking for ways to do this, rather than move their goalposts.

Use scenario planning to build contingency plans – Building on the comments from David and Chris, Laura gave some examples of practical tools to manage sponsor recovery or sponsor decline as we emerge from COVID-19. This circled back to advice from Richard that trustees should make their contingency plans legally binding.

Thinking green

A parting comment of my own highlighted the recent reduction in emissions and outperformance of companies with good ESG ratings over those with poor ESG ratings. Anticipating a green slant on government policy in the post-COVID-19 recovery, I would encourage everyone consider climate risks in the work they’ll be doing.

Find out where to focus your efforts

We’ve updated and relaunched our Annual Funding Statement segment identifier tool. This is free to use. With a few simple data inputs shows which of TPR’s segments (A to E) your scheme is in and the key actions you should be taking in response.

|