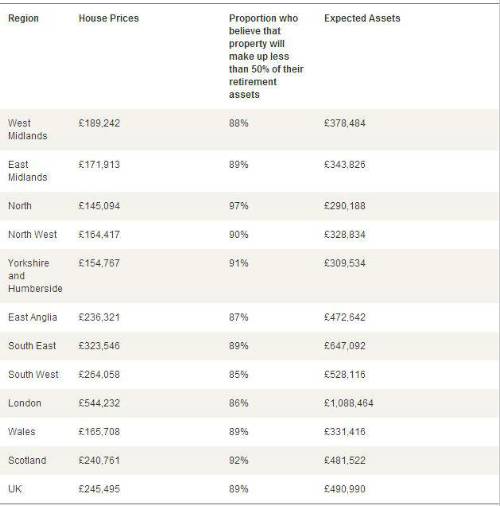

The majority of over-45s in the UK expect to retire with at least £490,990 in assets suggests new research from Partnership.

When 2,000 over-45s people were asked if their property would make up more than 50% of their assets when they retired, the overwhelming majority (89%) said no. Given that the average property is worth £245,495, this suggests that they expected to be worth a minimum of £490,990 when they retire (see table below). People in the South West (15%) were most realistic about the prospect of their home making up more than half of their assets, while those in the North (3%) were less so.

With the typical pension pot being worth £32,300, this research suggest that people have underestimated the proportion of their net worth in residential property and the role it may play in their later life finances. Indeed, 28% said that their property is their home and not an asset they plan to use in retirement and 26% saw their house as an asset that they could leave their children or other relatives.

However, up to 41% felt that property had a role to play in their later life finances. Indeed, 24% said they would use the equity in their property if they had to, 9% actively looking to make use of the value of their home and 8% planning to use this asset to pay for care.

Ged Hosty, Managing Director of Equity Release at Partnership said:

“While people over the age of 45 have arguably benefitted from unprecedented house price inflation, many people simply don’t realise this and are wildly optimistic about their retirement provision. This research also suggests that most people between the ages of 45 and 65 have not given serious thought as to what their net worth is – something that should definitely be done in the run up to retirement.

“When planning their later life finances, it is vital that not only do people consider all their assets when they retire but they also decide how they wish to use them. We find that most of our customers are older, have spent their annuity lump sum and have started to use their savings before looking to equity release to give their later life finances a boost.

“Using this product when they are older makes sense as they are more likely to be eligible for an enhanced equity release plan. However, it is vital to speak to a financial adviser to ensure that not only are you making the right choice but you are getting all the benefits you are entitled to.”

|