Currently, most Brits hold at least one form of insurance cover and 8 in 10 think insurance isn’t just for unlucky people (82%). However, more than two thirds are of the opinion that providers will do whatever they can to avoid paying out in the event of a legitimate claim (68%).

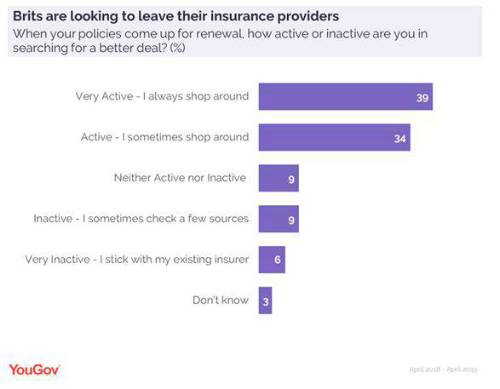

It’s therefore unsurprising that almost three quarters of current policy holders intend to switch providers in search of a better deal (73%). Of this group, two fifths classed themselves as ‘very actively’ shopping around (39%) with 9 in 10 using comparison sites as the first port of call (92%). Only 6% said that they would always stick with their existing insurer.

The least loyal customers are those with comprehensive motor insurance and joint home/building contents insurance where a third of both groups plan to change providers inside the next year (31%).

Those with private dental and medical cover are the most likely to stick with their provider – only 1% and 2% respectively are looking to switch.

Level of cover is the most important consideration across all categories of insurance with cost ranking second for those looking for motor, contents and mobile phone insurance. Brits with building/contents insurance are more concerned with their insurer’s reputation while those with pet insurance prioritise level of cover possibly as they’re the most likely to file a claim (50% have done so in the past year).

Commenting on the research, Matt Palframan, Director of Financial Services Research said: It’s clear that the insurance industry has some work to do to improve its reputation among customers, considering more than two thirds of the nation believe companies will try to avoid paying out. YouGov data already shows that insurance companies have a low opinion amongst the general public so it’s clear that providers could do more to generate confidence with the British public.

|