-

UK & Global investment company managers on the outlook for equities

At a time when indebtedness and generally low growth continue to impact upon countries' attempts to restore investor confidence, and with indices still performing disappointingly, the ability to stock-pick seems more important than ever. The Association of Investment Companies (AIC) has surveyed managers of investment companies focused both on the UK and globally, to gauge opinion on where opportunities can be found amidst the downturn. Many managers expect the US to be one of the leaders of any recovery.

Katherine Garrett-Cox, CEO of Alliance Trust said: "We are clearly operating in a post-crisis, low-growth environment associated with a multi-annual deleveraging process. This is not necessarily negative for equities - what is necessary, though, is better visibility of the drivers of the fledgling recovery. The Eurozone is the most obvious obstacle to the recovery and, as a result, is currently the principal cause of concern within equity markets. Our base case is that equity markets will be range-bound for some years, however this environment will present excellent opportunities for active management, particularly when decisions are made with a longer term investment perspective."

The outlook for UK and global equities is "hugely encouraging" believes Nick Train, manager of Finsbury Growth & Income. "Two multi-decade mega-themes are in their early stages of driving both corporate earnings and, crucial for the long term health of capital markets, new industry/company formation. These themes are, first, the entry into the global marketplace for goods and services of billions of new economic agents - the populations of the Emerging Markets - and, second, the accelerating impingement of digital technology into the day-to-day work and personal lives of all of us."

James Henderson, manager of Lowland, Henderson Opportunities and Law Debenture urges investors to be brave: "Investors are nervous and this is evidenced by the very low yields on government bonds. In the medium term it is not sustainable for UK gilts to yield 1.5%. The money in them will move into equities as confidence slowly rebuilds. Many investors will not enjoy the rise in equities because they are too defensively positioned."

Tom Walker, manager of Martin Currie Global Portfolio said: "Equities are neither cheap nor expensive in absolute terms, with uncertainty as to how they will react to global macro events over the next year. In relative terms, however, there are few better places to invest for the long term than in strong companies, many of which have balance sheets and profit-and-loss accounts that make government finances look shameful. Companies are nervous about making significant long-term investment commitments in the current environment, and thus are accumulating cash, some of which is being returned to shareholders through dividends and share buybacks."

Future innovation will propel stockmarkets

Nick Train, manager of Finsbury Growth & Income said: "The truth is, though, that many of the companies that will dominate world stock markets in 10 years' time do not yet exist - for instance those providing as yet unthought-of services to the communities built around Apple devices and Facebook."

James Henderson, manager of Lowland, Henderson Opportunities and Law Debenture sees growth opportunities in the UK and Europe and shares other managers' optimism for technology: "An area where UK companies can compete globally is technology-based manufacturing. These businesses are adding value with cutting-edge products. They are less dependent on fluctuating commodity prices and the ups and downs of the business cycle."

In terms of regions, the US still remains a port in a storm for many managers. Nick Train, manager of Finsbury Growth & Income said: "It is hard to look past the United States as the region most likely to house the world's most profitable and rapidly growing companies. The best corroboration of this constructive view is to note that so far in 2012 the world's biggest stock market is rising at an annualised rate of 10% and the world's most important stock market is rising at an annualised rate of 24% - namely the S&P 500 and NASDAQ. The NASDAQ is most important, because it is home to the technology companies which are changing the world. These gains are despite all the well-rehearsed worries about the euro."

Katherine Garrett-Cox, CEO of Alliance Trust agrees: "The US is likely to continue to lead the developed world out of the post-crisis doldrums and, importantly, it provides a great base to nurture the development of successful and innovative companies." However, she believes that Asia remains a significant opportunity: "Generally speaking, Asia should represent the best source of growth, but that does not equate to saying that Asian equities are the best vehicle to play that growth. Global active managers might be able to benefit from greater returns investing in companies located elsewhere, but significantly exposed to Asia and at Alliance Trust we spend a great deal of time analysing where a company generates its earnings, rather than simply focusing on the country in which it is listed."

Tom Walker, manager of Martin Currie Global Portfolio also sees the US as key to the recovery of global markets: "Of the developed markets, the UK and US have a better, if still challenging, economic outlook than Europe. The health of the US economy in particular is vital to the world economy, with emerging markets especially dependent on the US not falling back into recession."

Will investors' demand for income continue?

Some investment company managers are wary of investors' demand for income at all costs. Nick Train, manager of Finsbury Growth & Income said: "Investors' demand for income will remain as acute as ever. Regrettably, this will propel them into investments that are most unlikely to protect the long term purchasing power of their capital." James Henderson thinks the trend is already on the wane: "The premium paid for higher yielding equities is not sustainable where stronger growth comes through from lower yielding areas".

However, Katherine Garrett-Cox still sees the current value of income: "Within an environment characterised by low-growth and lower expected return from equities, income will continue to be an important component of added value. Dividend income pays shareholders to wait for capital growth to reassert itself and looks increasingly compelling against a backdrop of historically low interest rates, the returns from which are being eroded by inflation."

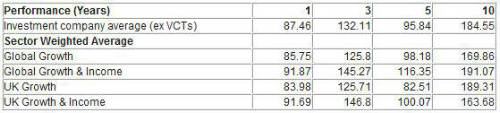

Sector performance, based on share price total return on £100 with net income reinvested, less 3.5% for expenses. Figures are AIC using Morningstar.

|