Adoption of technology progressed during the Covid-19 pandemic as the lockdowns drove people to digital processes. This has resulted in a growing confidence in use of technology, especially when it comes to managing finances.

Aegon’s latest consumer research shows nearly 8 in 10 adults (78%) manage their finances digitally and a quarter (26%) said they are now more confident doing this since the beginning of the Covid-19 pandemic. And, confidence is even higher in younger age groups, with 42% of under 35s more confident about managing finances digitally.

When looking at how people prefer to manage their finances, apps are the most popular way to view balances and transfer money. And, for those investing money or managing a pension, website and apps were the top two methods.

Scams still front of mind

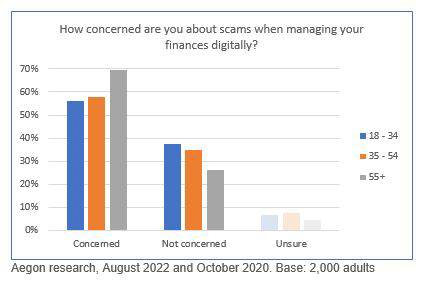

While confidence in digital use has risen, people remain wary of financial scams. Overall, 62% said they are concerned of scams when managing their finances digitally, but worryingly nearly a third said (32%) they were not concerned. Scam concerns were highest among the over 55 age group.

The Financial Ombudsman Service (FOS) has recently warned consumers about the growing risks of scams during the cost-of-living crisis, with people more vulnerable to approaches from fraudsters duping them into fake investments. Latest figures from the FOS reveal that investment scams are the fastest growing ‘authorised’ scam complaint that it now receives. And, just over a half of these involved cryptocurrencies, a form of digital asset.

Kate Smith, Head of Pensions at Aegon, comments: “The pandemic accelerated digital adoption and our research shows confidence has grown when it comes to managing finances digitally. People are looking to view their balances and transact ‘on the go’, with apps and online websites the preferred method for doing this.

“Digital services have created opportunities to engage people with their finances in new and innovative ways and financial providers can use these platforms to help support their customers. This could be via access to budgeting or goal planning tools or helpful information and articles to building financial wellbeing.

“However, while digital confidence has grown, so too has the threat from scams. Fraudsters have moved online and look to take advantage of the digital transition using evolving technology to their advantage. 62% of adults in our research were concerned of scams when managing their finances digitally, but this still leaves a good proportion not concerned about the threats they might face.

“The cost-of-living crisis could leave more people vulnerable to falling victims to fraud as they are lured in by investments offering higher returns or look to take out loans. It’s important that we keep scam awareness at the front of people’s mind, especially when managing their finances and transacting online.”

|