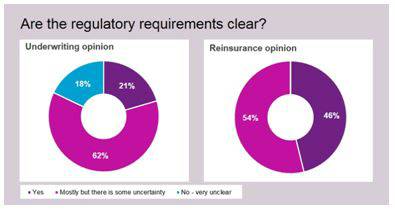

Of the insurers who took part in the survey of actuarial functions, 80% agreed there remains considerable uncertainty regarding regulatory requirements affecting the underwriting opinion in particular. However, 82% are yet to seek any external advice to help address this lack of clarity. The findings also showed that a significant number of respondents (13%) do not consider the underwriting policy or process when producing the underwriting opinion which, according to Willis Towers Watson, should be a fundamental step when producing an opinion.

“The lack of clarity around such a central Solvency II requirement is a major concern as underwriting policies directly impact an insurer’s performance, underlining the need for better guidance,” said Tammy Richardson, Managing Director, UK P&C Leader, at Willis Towers Watson. “The findings also reveal underwriting as an area where the actuarial function could be adding more value by helping to produce and assess the overall underwriting policy framework and providing independent challenge.”

Willis Towers Watson conducted the comprehensive survey of 39 property and casualty (P&C) insurers in the UK, with a combined underwriting value of over £10bn of premiums and over £24bn of reserves in 2017, in order to gauge progress made by the market in dealing with the Solvency II actuarial function requirements since the regulation came into effect two years ago.

In calculating their technical provisions, survey respondents found meeting the reporting timetable to have been the biggest challenge by far, with over 60% of respondents identifying this as an issue.

“With IFRS 17 fast approaching, timetables will continue to be squeezed and the pressure on insurers will intensify,” said Sanjiv Chandaria, Actuarial Function Product Leader at Willis Towers Watson. “In order to meet these challenges, insurers will need to develop more efficient processes primarily through the use of the latest Insurtech software and technology which will also free up scarce resources to focus on adding the most value.”

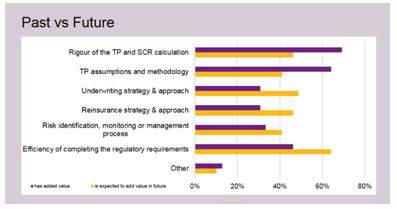

When asked where the actuarial function should focus on adding value in the future, 64% of respondents pointed to the need for improved efficiency of processes and calculations in order to meet regulatory requirements, most likely driven by current reporting timetable challenges.

“Many calculations are still predominantly spreadsheet based which is unlikely to help meet reporting timescales,” said Sanjiv Chandaria. “One way that current processes can be made more efficient is through the use of workflow management tools to integrate various tools, support better governance and enable automation. We’re seeing a real push in the market towards the use of such tools, as well as robotic process automation.”

“In order to make the best use of the latest technologies and software, however, a clear understanding of the regulatory requirements is an essential first step before implementing a more strategic approach to address today’s challenges of speed, frequency and cost.”

|