The earliest stagers were dominated by the giants of the high street, more recently supplemented by public  sector employers and a wide variety of household names from the private sector.

Opt-out rates have become an early measure of the effectiveness of auto-enrolment and on this basis it has been an unqualified success. Previous research on potential member behaviour indicated that about a third of members would opt-out. However early experience indicates opt-out rates closer to 10%, with ASDA publicly quoting 8% and NEST reporting an average of 10% across their schemes.

JLT’s experience reflects this with opt-outs in some populations as low as 2%, although rates are influenced by the scheme design and pre auto-enrolment participation levels. Where member contributions are higher than the initial phased minimum of 1% of salary the opt-out rates are typically in the 10%-20% range. Where companies already have high levels of participation the opt-out rates can be distorted and therefore appear high. For example Aviva reported that prior to auto-enrolment 99% of employees were members of their occupational DC scheme. 332 non-members were subsequently auto-enrolled of which 127 opted out. Viewed in isolation the opt-out rate of 38% is not representative of the excellent overall pension participation.

Opt-out rates are a useful benchmark of success, however over time it will be important to also understand the incidence of members ceasing membership outside of the opt-out window to get the full picture of participation levels. But the early signs indicate that inertia is a powerful force and once enrolled the vast majority are not taking action and end up saving for their retirement as a result.

Inertia also continues to be a powerful force for non-members. Opt-in rates are not attracting the same attention as opt-out rates, however in JLT’s experience these are also low. This places a great degree of importance on the auto-enrolment earnings trigger in determining what proportion of the working population is accumulating retirement benefits over and above the State pension.

Breaking the mould

The early stager scommitted significant levels of resource to their auto-enrolment projects, both financial and manpower, and allowed themselves plenty of time to prepare with 18 months being a common project duration.Early signs indicate that there have been no failures, albeit there have undoubtedly been a few last minute nerves as staging dates approached.

However, organisations staging in late 2013 and beyond are unlikely to have the time, money and influence to achieve similar outcomes and the way the pension industry has supported employers through automatic enrolment so far is not scalable or sustainable.

By the end of 2013 over 1,500 companies a monthreach their staging date and in mid-2014 over 30,000 companies will stage over a four month period. This peak is dwarfed when over 50,000 small employers reach their staging date each month consistently between 2015 and 2018.

The JLT 250 club is a group of leading companies that participate in regular topical research. In our November 2012 research we asked how long companies were allowing for implementation of their auto-enrolment processing. Answers were evenly distributed between 1 and 12+ months and rather than battling to convince these companies that they need to allow 18 months it is important that we develop solutions to meet these expectations.

The sheer volume of organisations staging each month means that the intensive projects of the larger organisations cannot be representative of how smaller organisations prepare for their staging dates and a 3 month auto-enrolment project has to become the norm rather than 18 months.

This will require levels of standardisation and self-service that currently donot exist. Bodies such a tPR, TPAS and NAPF may all play a crucial part in this, along with commercial organisations who are able to deliver relevant solutions at acceptable price points.

For the early success of auto-enrolment to be maintained it is crucial that these challenges of scale are met.

Better DC

Defined Contribution (DC) schemes will dominate auto-enrolment and as a result DC member outcomes are brought firmly into the spotlight.

Retirement outcomes from DC pension schemes can be transformed through better governance. Research undertaken by JLT and Cass Business School (Business Benefit or Blind Faith: Evidence based and outcome focussed governance for DC Schemes, 2012) concluded that DC outcomes can be improved by up to 40% through best practice in scheme design, investment and retirement processes.With strong central governance and some additional flexibility compared to contract based schemes, the early stages of automatic enrolment have seen the re-emergence of Master Trust as a popular pension scheme design.

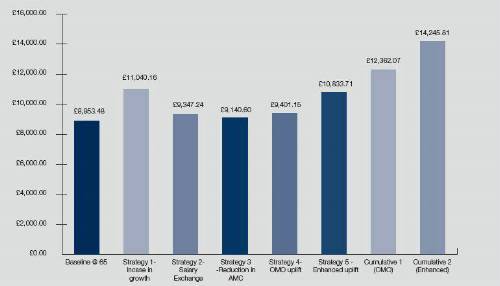

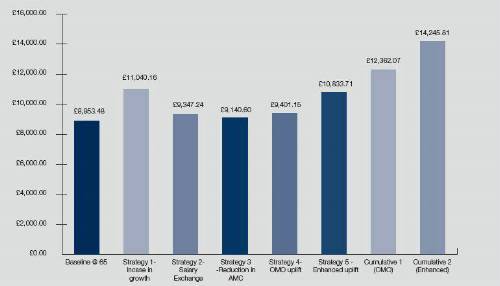

However even with good governance, for many people the minimum DC contribution levels under auto-enrolment are not enough to meet retirement aspirations, or even ensure an adequate retirement income.JLT estimate that an employee on median earnings contributing into a pension for 40 years requires a total pension contribution rate of 20% of auto-enrolment ‘band’ earnings to achieve the target retirement income recommended by the Pension Commission (67% of gross earnings, including State pension). Alternatively at the post-transition minimum contribution of 8%, employment and contributions would need to continue for a further 8 years to age 76![JLT graphic – JW?]

The first step

There is no doubt that the journey to being a financially independent nation in retirement is a long one. The statistics relating to improved longevity in the UK are well known, there are already more pensioners than under 16’s, an ageing society is not coming – it is already here.

So we have a long way to go and will need clear State pension entitlement, sensible levels of saving and well run pension schemes to get there. But getting people into a pension scheme is a necessary first step and auto-enrolment has made a strong start in achieving this.

Author: Mark Pemberthy is a Director at JLT Benefit Solutions

|

sector employers and a wide variety of household names from the private sector.

sector employers and a wide variety of household names from the private sector.