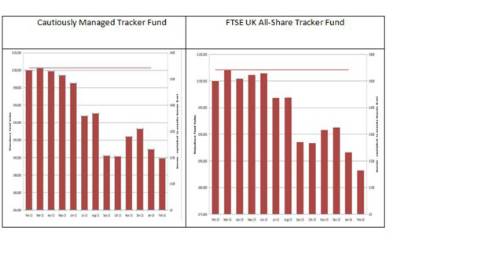

A 65-year old man who used a £100,000 pension pot to purchase an enhanced annuity in February 2015 would have secured a guaranteed monthly income of £542* (or £6,509 per annum) for life. However, if he had gone into drawdown and taken the same amount each month which investing in a Cautiously Managed Tracker Fund (value at end of first year - £89,916) or a FTSE UK All-Share Tracker fund (value at end of first year - £83,233) he would have seen his pot shrink dramatically.

Although the FTSE UK All-Share fund fell by 11%, the value of the drawdown pot fell by more than half as much again at 17%. The reason for this is effect of the ‘sequence of returns’ (as outlined in the graphic below). This shows that by taking a monthly income, the investor has severely eroded the value of their drawdown pot. Not only will it be difficult to recover this loss in the future if investment returns improve but the investor significantly increases the chances of running out of income in the future.

While many people use drawdown at the start of their retirement, some may eventually use the remaining income to purchase an annuity as they get older. Someone who had seen their fund lose over £16,000 in a year could be tempted to move to the relative safety of an annuity but would be shocked to see that the ‘purchasing power’ of their fund had fallen by £967 per year and they would only receive a guaranteed income of £5,539.

Billy Burrows, of William Burrows Annuities said: “This analysis highlights the huge risks facing people who choose to go into drawdown while at the same time investing their fund for growth. Although, they have made what may seem to be sensible choices by mirroring the income that they might receive from an annuity, market fluctuations mean that in twelve-months, they have lost over 16% of their pension pot.

“Not only will this be very difficult to recoup if they remain in drawdown but should they choose to purchase an annuity, they will find they have loss a significant amount of ‘purchasing power’. While investments naturally go up as well as down, it is important that people consider their income requirements throughout the whole of their retirement and take steps to secure a basic level of guaranteed income.”

Mark Stopard, Head of Product Development at Partnership, said: “An increasing number of people are using drawdown as they like the idea of having more control over their pension savings but it is all a balancing act that can be hard to get right! If a drawdown plan gets off to a bad start, it can be a very long road back to the sustainable income that an annuity could have provided. Someone who had invested in a FTSE All-Share Index in February 2015 might never have imagined that they could lose over £16,000 of their hard earned savings in one year but it is possible and needs to be factored in.”

|