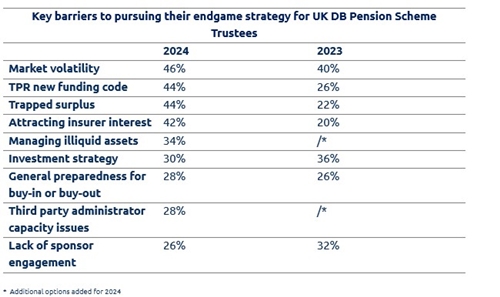

Market volatility remains a key challenge for DB pension scheme trustees when it comes to pursuing their endgame strategy, according to research from Standard Life, part of Phoenix Group, with almost half (46%) citing this as a key barrier.

The research, which surveyed 50 DB pension scheme trustees of schemes larger than £100m, exploring their concerns and considerations around their approach to de-risking, found that market volatility topped the list of key barriers for the second year running, with 40% of DB pension scheme trustees having cited it as the main obstacle last year. Various other factors also emerge as key barriers for DB pension scheme trustees, alongside market volatility. This includes the TPR’s New Funding Code (44%) which came into force in November, trapped surplus (44%), and attracting insurer interest (42%). Managing illiquid assets is also a barrier for 34% of schemes, as is their investment strategy more widely (30%).

Compared to responses to the same question in 2023, some of the key barriers cited by DB pension scheme trustees are quite different. While market volatility remains the key barrier, investment strategy (36%) came in second last year, followed by lack of sponsor engagement (32%), whereas this year these are slightly lower on the list of key barriers.

Kunal Sood, Managing Director of Defined Benefit Solutions at Standard Life, part of Phoenix Group, said: “While DB funding levels have proved remarkably resilient to market volatility, these results show that for the second year running, trustees remain concerned about its possible impact when it comes to securing member benefits. Trustees are also thinking about the changes that come with implementing the new DB Funding Code, which will require schemes and their sponsors to work together to develop a formal journey plan that targets de-risking and full funding on a low-risk basis.”

“It’s encouraging to see greater confidence in sponsor engagement and investment strategies, but the fact that there are still barriers underscores the need for careful planning. Securing member benefits requires more than reaching funding levels, and laying the groundwork can help trustees mitigate risks and manage obstacles. Insurance can play a crucial role in providing de-risking solutions to support schemes with their de-risking objectives. With attractive insurance pricing, BPA remains the gold standard for many schemes. For those schemes looking to this for their endgame strategy, by proactively addressing these challenges, and working closely with advisers and insurers, trustees can set their schemes up for a smooth and successful journey to buy-in or buy-out.”

|