The total value of bulk annuity business written in 2015 was worth £12.4bn, which though slightly down from the previous year’s total of £13.2bn, nevertheless constitutes the second-largest annual figure to date. 2015 saw plenty of activity at both the small and large ends of the bulk annuity market.

The largest deals in 2015 were clenched by the Civil Aviation Authority and Philips UK schemes, worth £1.6bn and £2.4bn respectively. These compared with three ‘mega deals’ of over £1bn in 2014, namely the £3.6bn buy-in of ICI (written by L&G and Prudential), the £2.5bn buyout of TRW (also written by L&G) and the £1.6bn buy-in of Total UK (by PIC). This differential in the overall volume of mega deals written is responsible for the slight decline in the total value of the bulk annuity market in 2015.

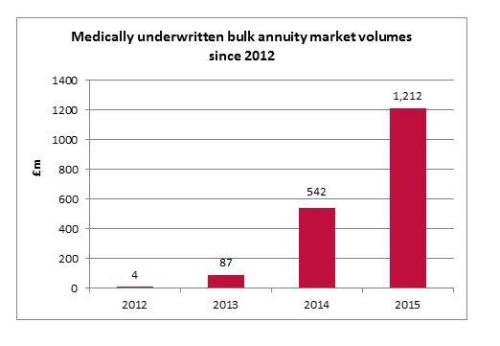

There is evidence that smaller schemes are increasingly looking to benefit from the longevity de-risking opportunities offered by both longevity swaps and bulk annuities, with the appearance of the first sub £100m “named life” longevity hedge, the first sub £100m “all-risk” bulk annuity transactions, and the first longevity swap (for £600m) to bring the benefits of avoiding intermediary costs to smaller scale transactions.

Outlook for 2016

The merger of Just Retirement and Partnership Assurance, completed earlier this month, has also created a very sizable new operator in the market for 2016, in the form of JRP Group plc. While this could reduce some degree of competition, the strength of the combined entity’s mortality experience data should have a positive effect on their pricing, particularly of impaired lives.

The arrival of new market entrants Canada Life and Scottish Widows in 2015 could herald a continued increase in market competition and capacity, with more new players expected this year. Another influential factor for 2016 is the implementation of Solvency II, with challenges in terms of pricing for certain liabilities. Despite this, the ongoing impact of the Government’s Freedom and Choice agenda should lead to a sustained appetite for deals from insurers.

Tiziana Perrella, Head of Buyout, JLT Employee Benefits, comments: “The year ending December 2015 was another fantastic year for bulk annuity business. Although the final figure fell slightly short of the year before, we can see that this was chiefly the result of multiple ‘mega deals’ in 2014.

“Similarly, the scale of bulk annuity business for the year ahead depends on the number of such deals which occur at the top end of the market. While we expect to see around £7.5bn of ‘natural’ bulk annuity volume – that arising from small and mid-sized transactions – total market capacity of more than £15bn is entirely possible with the addition of two or three of these ‘mega deals’.

“Despite the challenging economic climate making it more difficult for smaller schemes to get more than one quote from an insurer, opportunities persist for those that have done their homework in terms of data cleansing and formulation of a realistic price trigger. Going to market early and understanding which insurer(s) to approach are also key in securing the best price.”

|