Mercer and the CFA Institute released its 14th annual Mercer CFA Institute Global Pension Index (MCGPI). Iceland’s retirement income system has once again topped the list, with The Netherlands and Denmark retaining second and third places respectively in the rankings. The UK positioned tenth, down one place from its 2021 ranking.

As more employers have stepped away from defined benefit (DB) plans, the study also investigates the challenges and opportunities with the global shift towards defined contribution (DC) plans where individuals bear increased financial responsibility.

Commenting on the UK’s position in the index, Mercer’s UK Head of DC, Philip Parkinson said: “With the cost of living crisis front of mind, all hands including policy makers, trustees and providers need to work together with individuals to improve retirement outcomes.

“Failure to address some fundamentals around auto-enrolment coverage and savings levels and the levels of household debt, will build up over time leading to a retirement crisis for ‘Generation DC’.”

Senior Partner at Mercer and lead author of the study, Dr. David Knox, highlighted the importance of strong retirement schemes in light of growing external uncertainty: “Individuals have been assuming more responsibility for their retirement savings for some time; amidst high levels of inflation, rising interest rates and greater uncertainty about economic conditions, they are doing so in an increasingly complex and volatile environment. Despite differences in social, political, historical or economic influences across geographies, many of these challenges are universal. And while the necessary reforms may take time and careful consideration, policymakers must do all they can to ensure retirement schemes are supported, developed and well-regulated,” said Dr. Knox.

CFA Institute President and CEO, Marg Franklin, CFA, underscored the dynamic environment of the investment industry: Since the inception of the Mercer CFA Institute Global Pension Index, the investment management and pension industry at large have faced extraordinary challenges. New financial products and strategies will be required to deliver adequate returns for beneficiaries. This past year, we’ve gone from a ‘lower for longer’ interest-rate environment to significant rates of inflation, quadrupling of interest rates in some global markets and a rise in the cost of living for many, all of which have a significant impact on the fixed income of retirees,” said Ms. Franklin.

“At CFA Institute, we believe financial professionals can serve as a force for good in society to support individuals through this complex time. This report provides insights on how retirement plans need to adapt or are adapting to the changing environment, and also makes recommendations for a range of reforms that can be implemented to improve the long-term outcomes from our retirement income systems,” she added.

The shift to defined contribution (DC) increases uncertainty for retirees

As employers continue to step away from the financial security that has been offered in DB plans, individuals bear the risks and opportunities before and after retirement. Unlike DB plans where an individual receives regular, guaranteed income payments for life on retiring, typically DC plans provide individuals with a savings pot at retirement to manage and make big decisions about (often after a lifetime of low engagement). While in the UK, current government policy supports both the existence and the increase of the universal state pension (for those with the adequate level of qualifying years), many governments are considering reducing their level of financial support during retirement to ensure the country’s financial sustainability over the longer term. The UK will not be immune from that trend and we are already seeing consideration of changes to access age to reflect the state of the nation’s finances.

The result is that many individuals will no longer be able to rely on significant financial support from their previous employers and/or government during their retirement years. Therefore, it is essential individuals make good financial decisions at retirement to maximize the value of their available DC pension assets. Just as diversification is a key part to any investment scheme, individuals may also seek to diversify their retirement savings between regular income, appropriate protection and access to capital, as well as different sources of financial support including government, private pensions and individual savings.

“Households will have to consider what the right balance is between receiving a steady income, access to some capital and protection from future risks, given the many uncertainties faced by retirees,” said Dr. Knox.

“It is critical that we understand whether or not the retirement income systems around the world will be able to meet the needs and expectations of their communities for decades to come,” he continued.

“There is no single or perfect answer – the best system is the one that helps individuals maintain their previous lifestyles into retirement. Governments, employers, policymakers, and the pension industry should use the full array of products and policies available so individuals can retire with dignity, confidence, and financial security.”

By the numbers

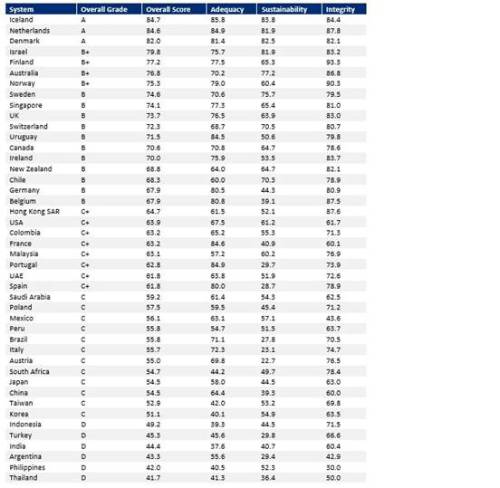

The MCGPI is a comprehensive study of 44 global pension systems, accounting for 65 percent of the world’s population. It benchmarks retirement income systems around the world, highlighting some shortcomings in each system, and suggests possible areas of reform that would help provide more adequate and sustainable retirement benefits.

Iceland had the highest overall index value (84.7), closely followed by the Netherlands (84.6) and Denmark (82.0). The UK positioned tenth (73.7). Thailand had the lowest index value (41.7).

The Index uses the weighted average of the sub-indices of adequacy, sustainability, and integrity. For each sub-index, the systems with the highest values were Iceland for adequacy (85.8) and sustainability (83.8), and Finland for integrity (93.3). The systems with the lowest values across the sub-indices were India for adequacy (37.6), Austria for sustainability (22.7), and the Philippines for integrity (30.0).

In comparison to 2021, Mexico showed the most improvement as a result of pension reform, which improved outcomes for individuals and pension regulation.

2022 Mercer CFA Institute Global Pension Index

Mercer CFA Institute Global Pension Index 2022 — Highlights

|