-

Rapid price fluctuations in local markets present opportunities for the prepared

-

DB buyouts expected to increase in North America and UK

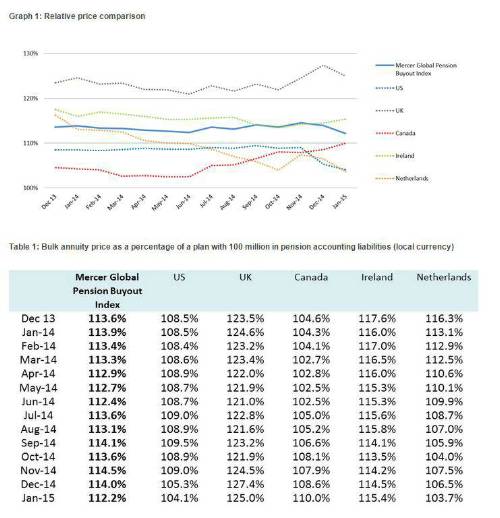

The Index tracks the cost of an insured annuity buyout relative to the corresponding pension accounting obligations in Ireland, the United States, Canada, the United Kingdom and The Netherlands. The Netherlands is notable as, unlike the other markets, the buyout index there has significantly decreased over 2014.

The Index shows that there continued to be country-specific periods of time – often only weeks – where more favourable terms are on offer from insurers. Managers and sponsors of plans which have invested in improving their plan’s member and benefit data, assets, and governance structures are most likely to be able to benefit from these windows.

According to Frank Oldham, Global Head of DB Risk at Mercer, “Insurer pricing has largely withstood volatile markets but there have been substantial monthly fluctuations in pricing in some markets relative to local accounting measures. This underlines the need for the managers and sponsors of defined benefit plans to be prepared and to monitor insurer pricing against pre-determined thresholds on a frequent basis so that they can move quickly when pricing does soften for their plan.”

United Kingdom

The cost of insuring a pension is more expensive in the UK than in other markets because UK pension liabilities tend to be indexed for price inflation. Relative pricing in the UK softened marginally over the first half of 2014, dropping from 124% in December 2013 to a 2014 low of 121% in June, before gradually rising to 127% in December 2014. The bulk annuity market in the UK continues to thrive with total transaction premiums in 2014 exceeding £12 billion. Mercer has been lead advisor on 25% by value of all bulk annuity transactions ever completed in the UK as well as lead adviser on all four buyouts involving premiums of over £1 billion (Thorn £1.1 billion, T&N £1.1 billion, EMI £1.5 billion, TRW £2.5 billion).

According to David Ellis, Mercer’s UK Leader Bulk Pensions Insurance Advisory, “Although three £1 billion plus deals have driven this record-breaking figure, activity amongst small to mid-sized pension plans remains vibrant despite low market yields.”

United States

Activity in the U.S. market has been increasing with two major deals announced in 2014 (BMY US$1.4 billion and MSI US$3.1 billion) and another in February 2015 (Kimberly-Clark US$2.5billion). These major buyouts are in addition to the over 300 non-jumbo deals totaling approximately US$9 to US$10 billion since 2011. Historically, most bulk buyouts were for full plan terminations but, recently, there has been a significant increase in the proportion of sponsors buying out retirees only.

This increase in activity is mainly attributable to rising PBGC premiums and more attractive annuity pricing compared to balance sheet liabilities. According to the Index, during 2014, annuity pricing relative to balance sheet liabilities was relatively stable at roughly 109%. However, as plan sponsors adopted new mortality assumptions for year-end financial reporting, the average premium declined to around 105%. This assumption update was in response to new mortality tables released by the Society of Actuaries in October 2014. However, these new higher longevity expectations were likely previously recognised by insurers, and have in general not affected the annuity purchase price. Consequently pension buyouts are now more attractive relative to the balance sheet liability in the U.S. Mercer expects this to drive increased buyout activity in 2015.

Canada

Canada saw a wide fluctuation in relative pricing of annuities throughout 2014. The buyout premium stood at 105% of plan liabilities in December 2013 and dropped to 103% by June 2014. In terms of the impact on corporate financial statements, the first half of 2014 appears to have been an opportune time for plans to complete a transaction. Relative prices then increased over the remainder of the year, moving towards 110%, due to changes in credit spreads and more conservative pricing from insurers. However, the market was still active throughout 2014, with approximately CAD$2.5 billion of bulk annuities placed. This exceeded the previous record of CAD$2.2 billion in 2013. Mercer expects growth in the demand for bulk annuities as plan sponsors continue to look for ways to reduce their pension risk.

In March 2015, the first ever Canadian pension longevity swap was announced. Though this deal did not involve an annuity purchase, at CAD$5 billion it is the largest pension risk transfer ever transacted in Canada and is indicative of a growing trend to reduce the risks associated with pension liabilities.

Ireland

The buyout market in Ireland has been relatively quiet throughout 2014, although the relative cost of a pension annuity transaction versus accounting liabilities has dropped slightly over the year, standing at 118% in December 2013 and decreasing to 115% by December 2014. With the fall in long-term bond yields over 2014, many Irish companies have seen their year-end DB pension accounting liabilities increase significantly from last year. The European Central Bank’s framework for quantitative easing will likely see continued downward pressure on yields in the short term making any immediate reversal of the increase in pension accounting liabilities and annuity costs unlikely. The annuity market in Ireland remains relatively quiet with plans focussed on ensuring their asset portfolios are positioned to capture risk-adjusted returns whilst the wider governance is in place to effect de-risking activity if/when market conditions permit.

Netherlands

In the Netherlands, most pension plans provide discretionary pension increases. Therefore, company accounts, if based on international accounting standards, show pension liabilities that include the expected level of pension increases to be provided.

The Mercer Global Pension Buyout Index offers a like-for-like comparison, showing an estimate of the buyout price of pensions including increases at the same level that is included in the corresponding accounting liabilities. However, it is important to note that when buying-out pensions in The Netherlands, the actual amount of pension increases purchased may be different to that shown in the company accounts, resulting in a settlement gain or loss.

The buyout market in The Netherlands has been around 2 to 3 billion euros per annum for the past few years. Given the number of pension plans in liquidation and the ongoing trend of consolidation in the Dutch pension market, Mercer expects the buyout market to be of continued substance into the future. Unlike the other countries, the buyout index for The Netherlands has significantly decreased over 2014 and has continued to decrease in 2015. This has been caused by the movement of the credit spread (from circa 70 basis points at the end of 2013 to circa 40 basis points at the end of January 2015) on high quality corporate bonds which are used for setting DB accounting liabilities. The yield on corporate bonds has further reduced as a result of the quantitative easing program of the European Central Bank, driving up accounting liabilities. By comparison the pricing of annuities by insurance companies has been less directly affected, as it uses a different pricing methodology.

The Mercer Global Pension Buyout Index shows the cost of estimated annuity prices from insurers as a percentage of accounting liability in each of the five countries. Local market factors also play a role. Each month’s figure is derived from insurer pricing that month, with potentially different insurers’ prices impacting the index value in a given month.

|