-

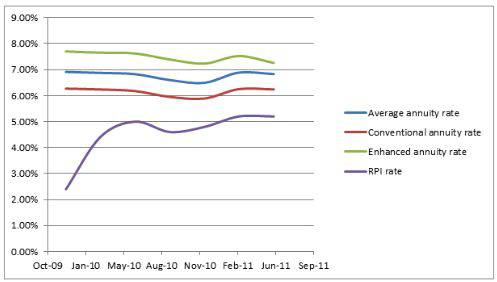

Conventional rates have fallen by 0.18% since March 2011 and enhanced rates have declined by 3.50%

-

In June 2011 the gap between RPI and conventional rates was 1.04% compared to 3.87% in December 2009

The latest findings from the MGM Advantage Annuity Index, which tracks the income paid on enhanced and conventional annuities on a quarterly basis, reveals that in the three months between March 2011 and June 2011, the average conventional and enhanced rates fell by 0.18% and 3.50% respectively.

Craig Fazzini-Jones, Director at MGM Advantage comments: "These findings will put further pressure on those people in retirement as they are living longer with an ever diminishing pot of money. We anticipate that this trend is set to continue. Given this, the need to shop around for the best possible annuity rate is becoming ever more imperative."

As annuity rates drop and inflation rises, the "real" income return on annuities decreases. In June 2011, the average conventional annuity rate was just 1.04% higher than the Retail Price Index (RPI), compared to 3.87% in December 2009. For enhanced rates, the gap was 2.06% and 5.30% respectively. For someone with a pension pot of £50,000, the fall in annuity rates plus the rise in inflation means that they would receive £101.24 and £316.36 a year less if they were buying a conventional and enhanced annuity respectively.

Craig continues: "Since launching our Annuity Index in June 2009, it has fallen six out of the seven times it has been updated, which is very alarming. As people live longer, the long term outlook for conventional and enhanced annuities is one of overall falling rates. This makes it all the more important to shop around for the best deal when buying an annuity as the difference between the best and worst rates can be huge."

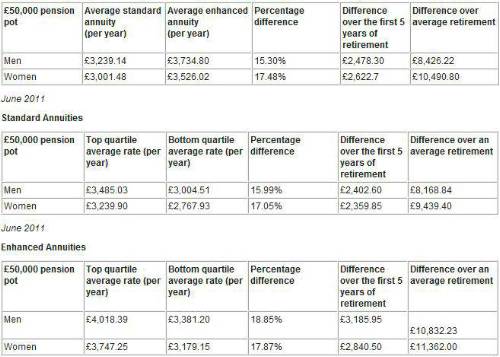

The latest findings from the Index reveal that the average difference in the income paid between the top and bottom quartile conventional annuity rates for men is 15.99% and 17.05% for women. In relation to enhanced annuity rates, the corresponding figures are 18.85% and 17.87%.

The difference between the average standard and enhanced annuity rates is 16.35%. Over the average retirement, this would amount to £8,426.22 for men and a huge £10,490.80 for women, on a pension pot of £50,000.

Given the overall trend for falling annuity rates in conventional and enhanced annuity rates, MGM Advantage says that greater consideration should be given to alternative retirement income solutions that can really make the most of people's retirement savings.

In February 2010, MGM Advantage launched a new and unique asset backed annuity - the Flexible Income Annuity. While the gap between top and bottom quartile conventional annuities continues to grow, the Flexible Income Annuity can offer the potential for investment growth, an income that can provide a natural hedge against inflation and it also comes with a minimum income guarantee for peace of mind. One of the problems with level conventional annuities is that income is fixed for life and falling rates means this income is shrinking all the time.

|