Taking positive action when they can to boost savings could be hugely beneficial for the future living standards of midlifers

Expectations of a comfortable retirement aren’t limited to those on higher salaries – nearly one in three of UK adults earning between £20k - £50k expect this

Research by Phoenix Group’s longevity think tank Phoenix Insights has found achieving a comfortable retirement is the top long-term savings goal for people in midlife, but many face an uphill challenge to meet this standard**.

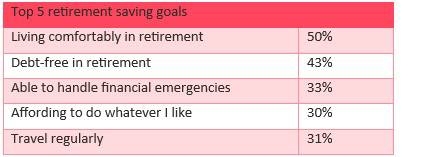

Retirement saving goals

Midlife is a key life stage which often prompts people to think about their future finances, with retirement less than 10 years away for some of this group. The research found 5.2 million of this group (59%) are taking action to save more for retirement, including spending less on holidays and luxury items, looking for a second job and prioritising long-term over short term saving.

When it comes to savings goals for later life, half (50%) of midlifers say they are targeting a comfortable retirement, and 43% are aiming to be debt-free before reaching retirement. The ability to pay off a mortgage will be a significant influence on being debt-free – Phoenix Insights modelling suggests over 13 million people are likely to face ongoing rental or mortgage costs in retirement.

Table: Base: 2,000 UK adults aged 45-54 who are not retired. Multiple selection question.

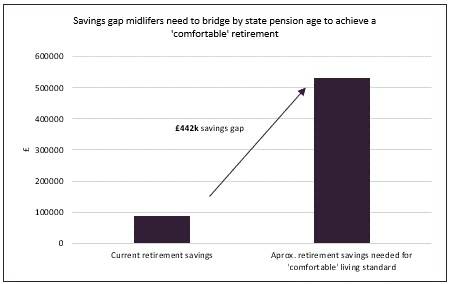

Expectations of a comfortable retirement will vary, but it is recognised that living comfortably means you have good financial security and the freedom and flexibility to do the things you want to do. The PLSA ‘retirement living standards’ suggest a savings pot of around £530k in today’s money terms is needed at for a comfortable retirement, and that’s on top of state pension income*.

The average amount people in midlife say they have currently saved for retirement is £88k, meaning they will need to save an additional £442k (in today’s money terms) by the time they reach state pension age to achieve comfortable retirement – around six times their current saving pot.

Graph 1: Savings gap between current average savings among 45-54-year-olds and the amount needed for a comfortable retirement living standard at state pension age (in today’s money terms).

Expectations of a comfortable retirement aren’t limited to those on higher incomes. Additional Phoenix Insights research found nearly one in three UK adults with a salary between £20,000 and £49,999 expect an income of at least the PLSA’s ‘comfortable’ retirement living standard.

Phoenix Group’s Patrick Thomson, head of research and policy at Phoenix Insights, comments: “Half of people in midlife have an ambition to live comfortably in retirement despite only around one in ten current retirees having a retirement income that is deemed to be comfortable. However, taking positive steps to save more where possible can make a big difference to retirement income prospects.

“Midlifers are fast approaching retirement but are among the least financially prepared for this. As a generation they have typically missed out on final salary pensions and also the introduction of a lifetime of workplace pension saving through auto enrolment. Our research shows some are looking to save more where they can, from spending less on holidays and luxuries items to renting out a spare room. But a significant group is still at risk of sleepwalking into retirement without sufficient savings to fund it.

“Not everyone will be able to save more, especially amid current cost-of-living pressures, so it’s important there is an adequate financial safety net from the state to support people in retirement. There is currently a lot of speculation around the future of the state pension, both in terms of age of access and how much people will receive, but whatever changes might be down the road, we need to ensure the system helps the most financially vulnerable and prevents poverty in later life from worsening.”

|