• Proportion of Military Family saying needs not met – up 13% since 2014.

• Only 21% feel they fully understand their existing insurance policies.

• Frustrations with specific service issues up 50% or more.

At a time when the total population of the Military Family is estimated to have reached 20 million, or roughly 31% of the British population, the limited range of policies and services on offer that take account of many of the Military Family’s particular and varied circumstances leaves the community feeling badly served and shut out.

This disconnection continues with only 21% saying they fully understand the policies they have taken out and are happy with them. This figure drops amongst the younger respondents to just 18% for those under 35.

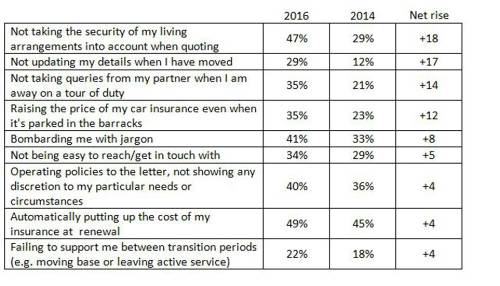

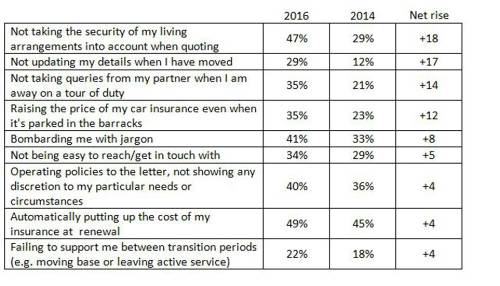

Amongst their frustrations, some were more pronounced than others. Respondents were 18% more likely in 2016 to find that insurance companies did not take the security of their living arrangements into account when quoting – an issue for almost half of those asked. Further, the perceived issue of insurance companies not updating a customer’s details when they moved shot up from 12% to 29% over the last two years. Members of the Military Family polled were also 14% more likely to find insurance companies refused to take queries from them while their partner was away on tour than they were in 2014. Looking at a range of service issues, on every count dissatisfaction with the general insurance industry had risen.

Specific ways insurers have not met the needs of the Military Family: A two-year comparison

Major General (Ret’d) Sir Sebastian Roberts, Chairman of The Military Mutual said: “The needs of the Military Family are simply not the same as those of the civilian consumer when it comes to personal finances. These results show exactly this and portray a community that is frustrated and doesn’t believe it is understood or valued by the insurance industry as a whole. Many of the answers given paint a picture of disconnection and members of the family feeling ‘shut out’, which is not conducive to helping members taking control of their financial wellbeing or transitioning into civilian life.

“The Military Mutual has spent the last year listening to the community, our members that in fact own the organisation, and we have worked hard to develop a service and product range that meets the needs of those that we serve – our members. We have a number of new services launching over the summer months that will help us fulfil our goal of delivering products that are appropriate, fairly priced – and that fully put the Military Family and those that support it first.”

|